TrueUSD’s market cap has been on the rise, which historically was followed by hikes in BTC’s price. Metrics also pointed at a possible market bottom.

- Bitcoin’s NVT Signal reached a one-month low on 25 August.

- The king coin’s exchange reserve declined, and other metrics also turned bullish.

After the last price correction on 16 August, Bitcoin’s [BTC] price settled around the $26,000 mark. While several investors remained bearish on the market condition, BTC might be planning a silent exit from its current price trend.

We might be at a market bottom

According to CoinMarketCap, BTC’s price dropped by more than 1.5% in the last 24 hours. At press time, it was trading at $26,090.91 with a market capitalization of over $507 billion.

However, the bearish price trend might end soon. Tedtalksmarco, a popular crypto influencer, recently posted a tweet highlighting an interesting development.

As per the tweet, TrueUSD’s [TUSD] market capitalization has been increasing of late. This happened while most of the other stablecoins’ market cap graphs remained relatively flat. Historically, whenever TUSD’s market cap has risen, BTC’s price has followed suit.

Such episodes happened earlier this year in January, March, and July, giving hope for a price uptick this time as well.

Moreover, Glassnode’s data revealed that BTC’s NVT Signal just reached a 1-month low of 1,292.206. A low NVT signal indicates that investors were pricing Bitcoin at a discount.

Also, the low NVT Signal suggested a possible market bottom, indicating that this was the right time to accumulate Bitcoin. In fact, whales have already started accumulating, a sign that they were expecting the coin’s price to surge in coming days.

Recently, addresses holding between 10 and 10,000 BTCs added about 11,629 coins to their existing supply since the crash on 17 August.

A Bitcoin bull rally is around the corner

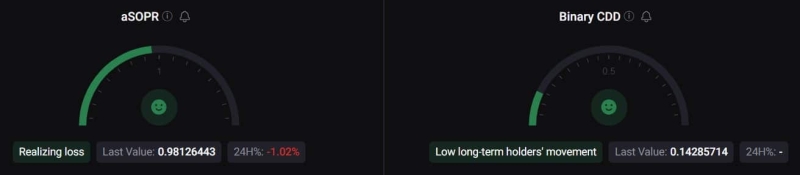

Not only the aforementioned updates, but several other metrics also supported the possibility of a price uptick. For instance, BTC’s exchange reserve decreased. BTC’s aSORP was green as well.

This meant that more investors were selling at a loss. However, in the middle of a bear market, it can indicate a market bottom.

Another bullish metric was Bitcoin’s Binary CDD was green, suggesting that long-term holders’ movements in the last seven days were lower than average. Additionally, as per Coinglass, Bitcoin’s Open Interest had declined, increasing the chances of an upcoming trend reversal.