Ethereum’s billionaires seize the crypto tide, accumulating riches amidst price turbulence while smaller wallets recede. Wealth dynamics shift in the crypto realm.

- Ethereum’s supply held by wallets with over 1 million ETH was over 32% at press time.

- ETH was still around the $1,500 range with a minor addition in value.

Billionaire Ethereum [ETH] holders have been actively accumulating assets, and their wallets have just reached a new all-time high. It is pertinent to note that price movements of ETH have significantly influenced this accumulation trend.

Read Ethereum’s [ETH] Price Prediction 2023-24

Ethereum billionaires want more

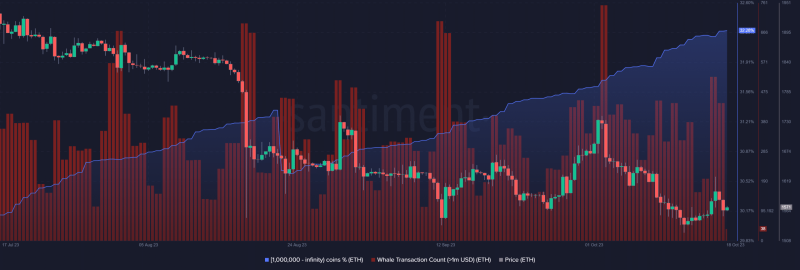

A recent report from Santiment revealed that Ethereum whales, those with 1 million or more ETH in their wallets, have increased their ETH holdings. The data indicates that the percentage of total ETH supply held by these wealthy addresses reached 32.3%, a level not seen since 2016.

As of the most recent data available, these whale addresses collectively held approximately 32.28% of the total supply.

Additionally, there was a notable increase in the volume of transactions involving these large whale wallets. According to Santiment’s findings, the volume of whale transactions reached its second-highest level in the past five weeks.

This suggests a clear correlation between the surge in transaction activity and the accumulation of ETH by billionaire wallet holders.

How do smaller Ethereum wallets compare?

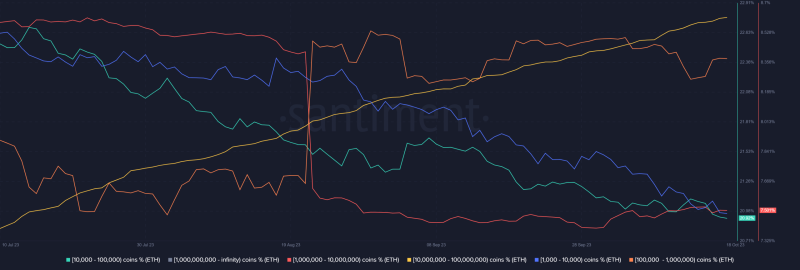

A deeper analysis of Santiment’s distribution chart revealed an interesting trend. While larger wallets were actively accumulating Ethereum, smaller wallets appeared to be reducing their holdings.

Specifically, when looking at the wallet tiers containing 1,000 to 10,000 ETH and 10,000 to 100,000 ETH, there was a decrease in their supply distribution.

As of the most recent data, the wallet tier with 1,000 to 10,000 ETH holdings accounted for approximately 11.19% of the total supply, down from around 11.23%.

Similarly, the wallet tier with 10,000 to 100,000 ETH holdings represented about 20.9% of the total supply, down from over 20%. In contrast, wallets belonging to millionaires and higher wealth categories exhibited an increase in their supply distribution.

ETH price movements show a pattern

Upon examining the daily timeframe chart of Ethereum, one immediately notices significant price fluctuations on 16 and 17 October, resulting in both over 2% gains and losses in the ETH price.

These price swings coincided with a noticeable surge in whale transaction volume, as observed on Santiment. At the time of this writing, Ethereum was trading at approximately $1,560, showing a modest price increase of less than 1%.

Furthermore, it’s worth noting that the most recent spike in whale transactions, which is the highest recorded in the past four months, aligned with a major price movement that occurred around 1 and 2 October.

How much are 1,10,100 XRPs worth today?

From the observed Ethereum price movement, whale transactions, and accumulation trends, it became apparent that as Ethereum prices declined and smaller addresses sold off their holdings, millionaire, and billionaire addresses increased their accumulation.

This suggested a shift in wealth distribution, with larger players taking advantage of price declines.