Contents

XRP’s price action might head in either direction in the near term, but it all depends on a few key factors.

Edited By: Jibin Mathew George

- On-chain metrics revealed that exchanges have seen outflows of XRP worth $29.5 million

- Traders seemed to be over-leveraged at $2.52 on the lower side, and $2.63 on the upper side

Despite market uncertainty, XRP has been projecting some strength on its price charts. In fact, it is now garnering significant attention from crypto enthusiasts due to its bullish price action. The timing here is interesting, especially since less than 24 hours ago, Bybit was hacked and $1.4 billion in cryptos drained. As expected, this triggered multi-million-dollar liquidations and a sharp market decline across the board.

XRP price momentum

Like the rest of the market, XRP’s value fell after news of the exploit broke out. And yet, at the time of writing, the altcoin seemed to be recovering somewhat. Its rate of depreciation slowed down over the last 24 hours. At press time, the altcoin was trading near $2.60, following a 3% price drop in the last 24 hours.

On the contrary, investor and traders’ interest surged, resulting in a 47% hike in trading volume.

It can be speculated that this uptick in participation was driven by increasing optimism associated with the idea of Spot XRP ETFs being approved in the near term.

XRP’s price action

According to AMBCrypto’s analysis, XRP appeared bullish on the charts as it formed an ascending triangle pattern on the four-hour timeframe. At press time, the altcoin’s price was holding support at the ascending trendline and the horizontal level of $2.50.

Historical data also revealed that whenever XRP touches its trendline, it tends to gain upside momentum. For instance – The last time the crypto hit the $2.50-mark, it surged by 10%.

XRP price prediction and technical analysis

A look at the prevailing price momentum revealed that XRP formed a bullish engulfing candlestick pattern at the horizontal resistance and trendline support – A sign of a potential upside rally.

Based on its recent price action, if the asset holds above the $2.50-level, there is a strong possibility it could surge by 10% to hit $2.85 in the coming days.

However, if market sentiment remains unchanged and XRP breaks out of the ascending triangle pattern, closing a four-hour candle above the $2.8- level, it could gain an additional 15% momentum. If it does so, it will climb to the next resistance level at $3.25 in the coming days.

Despite a bullish outlook, however, XRP seemed to be trading below the 200 Exponential Moving Average (EMA) on the four-hour timeframe – Indicative of a downtrend in the short term.

Meanwhile, the asset’s Average Directional Index (ADX) had a reading of 15 – A sign that its upside momentum was weak.

Bullish on-chain metrics

Long-term holders and investors have also been accumulating XRP tokens, according to on-chain analytics firm Coinglass. This lends further credence to the altcoin’s bullish outlook.

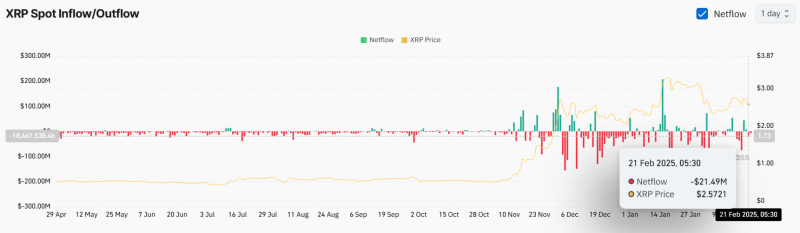

In fact, the altcoin’s Spot Inflow/Outflow metric revealed that exchanges have noted significant outflows of $29.5 million in XRP in the last 48 hours alone. During a price recovery, such exchange outflows are considered a bullish sign as they can create buying pressure and drive further upside.

At press time, the major liquidation levels were at $2.52 on the lower side and $2.63 on the upper side, with traders being over-leveraged at these levels.

Additionally, these levels are likely to act as strong support and resistance. Especially since traders have built positions around them based on today’s market conditions.