Polygon’s latest collaboration with Google Cloud did leave MATIC in a good place, however, traders may have to do much more than just have a positive sentiment around the altcoin.

- Polygon’s latest announcement involved making Google Cloud a part of the decentralized validator set for the network.

- MATIC responded positively to the news but healthy recovery was still a distant dream.

The last 30 days haven’t been the easiest on Polygon [MATIC], especially considering the price action of the altcoin. However, that may soon change as MATIC did show some movement in the green over the last seven days.

Data from CoinMarketCap showed that at press time the altcoin was exchanging hands at $0.522. This was 0.34% higher in the last 24 hours and 0.39% higher over the last seven days.

Read Polygon’s [MATIC] Price Prediction 2023-24

While this news was enough to make investors a little hopeful about what’s to come, PolygonLabs made another critical announcement. As per Polygon’s latest announcement, Google Cloud became a part of the decentralized validator set for the Polygon PoS.

This month, @GoogleCloud became part of the decentralized validator set for Polygon PoS.

The same infrastructure used to power @YouTube and @gmail is now helping to secure the fast, low-cost, Ethereum-for-all Polygon protocol.

With 100+ validators securing the Polygon PoS…

— Polygon (Labs) (@0xPolygonLabs) September 29, 2023

Additionally, the announcement also stated that anybody can monitor the performance checkpoint signatures for all Polygon PoS validators.

How did MATIC react to this?

At the time of writing, MATIC was exchanging hands 0.84% higher than its opening price of the day. This was an indication that MATIC had a positive reaction to the news. Furthermore, the Relative Strength Index (RSI) showed some improvement as it climbed a bit higher to stand at 46.33 at press time.

A rise in the RSI was a clear indication of increased buying pressure in the market. Furthermore, the Moving Average Convergence Divergence (MACD) mirrored the sentiment as the MACD line (blue) was moving above the signal line (red). An indication that the momentum was in favor of the bulls.

Despite the aforementioned indicators in favor of the altcoin, MATIC’s Money Flow Index (MFI) steered in the opposite direction.

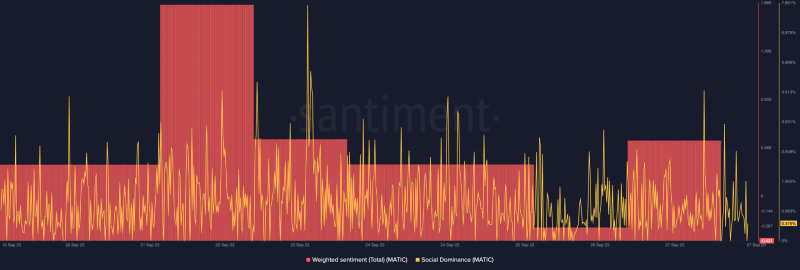

Furthermore, a look at Santiment’s data didn’t exactly scream bullish. This was because although there was some development in the social dominance metric, its weighted sentiment was struggling to recover. At the time of writing, while an improving social dominance was seen at 0.575%, the weighted sentiment stood at -0.431.

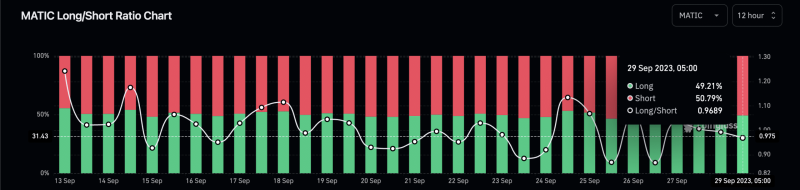

Additionally, Polygon’s latest announcement also failed to push MATIC holders toward holding the altcoin for the long term. This was evident by looking at MATIC’s long/short ratio. Despite the nature of the news, MATIC’s long/short ratio stood at 0.9689.

Is your portfolio green? Check out the MATIC Profit Calculator

This indicated that the number of short positions outnumbered the number of long positions.

While MATIC’s long/short ratio could see a change of heart in the hours to come, the threat of holders shorting the alt to exit their positions at a fair profit stayed put.