Ripple could be on the verge of a drop as risk elevates due to increased leveraged positions.

Edited By: Adewale Olarinde

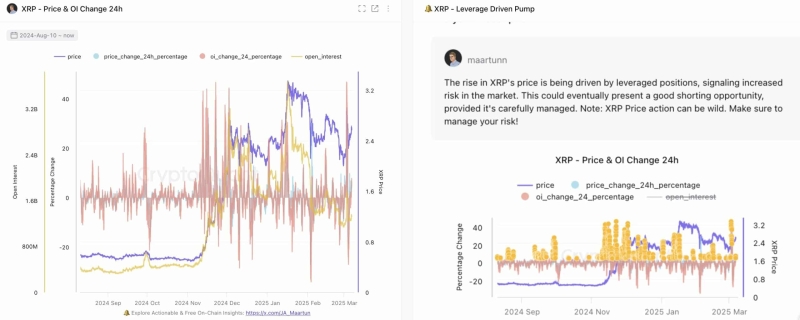

- XRP’s Open Interest has risen by 5.63%, it dropped after an internal buy-side liquidity sweep.

- The rise in XRP’s price is being driven by leveraged positions, signaling elevated risk in the market.

Ripple’s [XRP] price chart showed a volatile market, with the price recently oscillating around the $2.50 level, marking crucial internal sell-side and buy-side liquidity points.

Liquidity sweeps often precede major moves, as observed when XRP dropped after buy-side liquidity ran around the $3.00 zone.

In particular, after reaching a peak of $3.38, Ripple has dropped to its current level of approximately $2.50.

This decline is supported by MACD fluctuations, which indicate convergence toward the zero line, reflecting indecision in market momentum.

Recent downtrends and the MACD moving into negative territory suggest a high probability of XRP dropping below $2, signaling increasing bearish momentum.

A breakdown via XRP’s sell-side liquidity internal of $1.96 can prompt further decline, and this directs sellers to go even lower on sales. Conversely, trading above that level for the longer term can remove short-term bearish bias away and underpin the price.

Overall, caution remains in tone and sentiment, and positioning may emerge for deeper slides if gigantic supports are broken.

How could XRP-leveraged positions fuel a drop?

Analyzing the Open Interest (OI) offers insights into why Ripple’s price might decline, according to CryptoQuant analyst JA Maartunn.

XRP’s OI increased by 5.63%, which often results in price movements driven by leveraged bets in the market.

When open interest rises, it introduces greater market risk due to the influence of leveraged positions. Historically, changes in open interest have caused significant price volatility, leading to swings in both upward and downward directions.

This pattern suggests that the recent rise in OI could potentially trigger another large price movement soon.

The closeness of daily price movement and percentage movement in open interest demonstrated the effect of leverage on market action. In the wake of these analyses, a whale transferred 60 million XRP worth around $156 million from one unknown wallet to another.

As leverage increases, the likelihood of extreme price reversals grows, heightening the risk of steep declines if sentiment turns negative.

On the other hand, favorable price action and sustained positive momentum can result in significant profits for traders.

However, leveraged trading remains inherently risky, requiring cautious investments due to the high possibility of rapid market reversals.