Bitcoin’s price increased by 12% in the last seven days, but market sentiment has turned bearish.

Edited By: Saman Waris

- Bitcoin touched $47k, fueling speculations of prices touching $50k.

- Several market indicators remained bullish, but Weighted Sentiment dropped.

Bitcoin [BTC] has been steadily moving upward over the last few days. The bullish price action has allowed the king coin to move above quite a few notable levels, most recently the $47,000 mark.

In fact, at press time, BTC was inching towards $49,000. Therefore, should investors expect Bitcoin to reach $50,000 as the new week begins?

Bitcoin to $50,000 soon?

According to CoinMarketCap, BTC’s price has risen by more than 12% in the last seven days. In the last 24 hours alone, the king of crypto’s value surged by 2%, which looked optimistic.

At the time of writing, BTC was trading at $48,380.51 with a market capitalization of over $949 billion. This price uptick stirred up interest among investors as they expected Bitcoin’s value to rise further.

As per Santiment’s tweet on the 10th of February, traders were speculating on potential support and resistance levels.

Therefore, AMBCrypto took a closer look at BTC’s press time state to better understand whether it could touch $50,000 this week.

We checked Bitcoin’s liquidation heatmap to look for any notable resistance levels before $50,000.

Our analysis showed that BTC faced strong resistance near the $49,000 mark. For the uninitiated, when the king coin’s price hit that mark last time, its liquidation spiked, causing a minor price correction.

If BTC manages to go above this level, then the possibility of BTC effortlessly moving to $50,000 is high.

The situation might get dicey

AMBCrypto then analyzed BTC’s daily chart to see what market indicators suggested. The MACD displayed a clear bullish advantage in the market.

The Chaikin Money Flow (CMF) also registered a sharp uptick, indicating that the king of crypto’s price might rally further. However, a few indicators told a different story.

For instance, BTC’s price had touched the upper limit of the Bollinger bands. The Relative Strength Index (RSI) entered the overbought zone.

This can increase selling pressure on the token, which, in turn, might put an end to its bull rally.

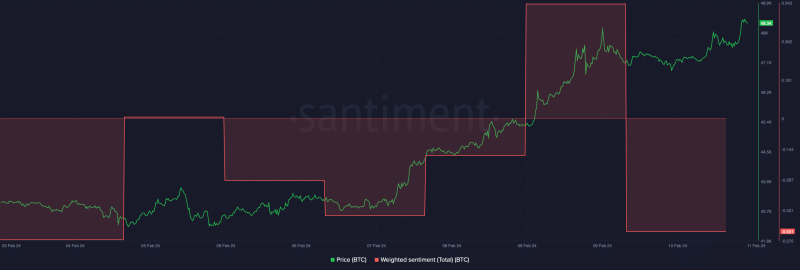

It is also surprising to note that despite the price uptick, sentiment around BTC turned bearish. This was evident from the massive drop in BTC’s Weighted Sentiment on the 10th of February 2024.

Thus, investors seemed to be losing confidence in BTC at press time, which could bring about a price correction soon.