Bitcoin bulls are already reclaiming a BTC price slide that came after the Bitcoin Strategic Reserve executive order fell short of market expectations.

3433 Total views 4 Total shares Listen to article COINTELEGRAPH IN YOUR SOCIAL FEEDFollow ourSubscribe on Bitcoin (BTC) rebounded 4% on March 7 as markets shook off disappointment over the US Strategic Bitcoin Reserve. Data from Cointelegraph Markets Pro and TradingView showed BTC/USD recovering from local lows of $84,713 on Bitstamp. These came as US President Donald Trump signed a long-awaited executive order establishing the reserve, which will consist of no “new” BTC; only confiscated coins will form the stockpile. “Premature sales of bitcoin have already cost US taxpayers over $17 billion in lost value. Now the federal government will have a strategy to maximize the value of its holdings,” David Sacks, the White House crypto czar, wrote in part of a post on X.

JUST NOW!

President Trump signs an Executive Order establishing the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile 🇺🇸 pic.twitter.com/N9p2sQknVS

— Margo Martin (@MargoMartin47) March 7, 2025

Markets initially fell swiftly on the event as bulls’ hopes for additional BTC acquisitions vanished.

“For what it’s worth, this is not the ‘reserve’ that crypto bulls had in mind,” trading resource The Kobeissi Letter explained in an X reaction.

“A clear sell the news event with expectations not being met.”

The subsequent Asia trading session nonetheless witnessed renewed strength ahead of the White House Crypto Summit set for later.

Longtime industry commentators saw little reason for cold feet given the overall stance of the new US government on crypto.

“I still don’t understand how people fail to distinguish between bullish and non-bullish news,” analyst BitQuant said.

“I can’t recall a time when Bitcoin was more bullish, yet they still manage to manipulate you into panicking at the bottom.”

Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, described the market as “excessively short” at the sub-$85,000 lows.

“Bitcoin always overreacts on news, both up and down,” he contended.

Jobs, Fed’s Powell to enter crypto volatility mix

The reserve was not the day’s only potential volatility catalyst on traders’ radar.

A raft of US employment data was due on March 7, along with a speech by Jerome Powell, chair of the Federal Reserve.

A week after the Fed’s “preferred” inflation gauge arrived in line with expectations, markets have been gradually increasing their expectations over the number of interest rate cuts occurring this year.

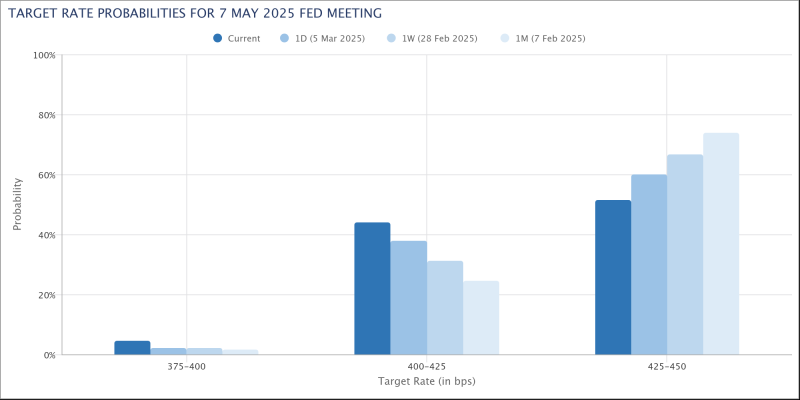

The latest data from CME Group’s FedWatch Tool showed 11% odds of a cut at the Fed’s March meeting, and much higher for its May meeting — almost 50%.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.