While ripple’s latest acquisition may show the company’s massive growth plans, XRP stuck to its original position and showed bleak aciton on the price front.

- Ripple’s latest acquisitions underscore its plans to tap into institutional liquidity.

- XRP remains downcast despite a bullish-centric sentiment shift.

Ripple is starting to gain momentum in its developments just weeks after its initial victory against the SEC. The network is making strategic moves aimed at expanding its sphere of influence.

Is your portfolio green? Check out the XRP Profit Calculator

Ripple recently announced its acquisition of Fortress Trust. This announcement comes shortly after the company’s previously announced Metaco acquisition for roughly $250 million. The latter makes it one of the largest acquisitions in WEB3. So how do these acquisitions fit in Ripple’s grand scheme of things?

Today, we are announcing intent to acquire Fortress Trust, part of the @Fortress_io suite of companies. Fortress Trust’s financial and regulatory infrastructure complements and expands Ripple’s comprehensive portfolio of blockchain solutions for finance. https://t.co/LIl3cPEur2

— Ripple (@Ripple) September 8, 2023

Well, Metaco provides crypto custody services while Fortress Trust offers enterprise crypto market infrastructure. Based on this alone we can see that Ripple is preparing to be one of the biggest WEB3 players contributing to enterprise crypto adoption hence the custody service acquisition.

The company also recognizes the need to have the right infrastructure in place to encourage institutional participation. Ripple’s CEO Brad Garlinghouse had this to say about the acquisition;

“We’re excited to bring on this team and its technology to accelerate our business and continue pressing our advantage in the areas critical to crypto infrastructure.”

Will XRP benefit from these developments?

Ripple’s acquisition of Fortress Trust basically allowed it to expand its regulatory license portfolio. The acquisitions elevate Ripple’s preparedness to support a wave of institutional liquidity into the crypto market in a custody-based approach. If this strategy works, it could put XRP in the cross-hairs of institutional demand.

While XRP’s prospects have improved, its price action remained in low-volatility limbo after losing its July gains. One XRP coin would set you back $0.50 at the time of writing.

Read about XRP’s price prediction for 2024

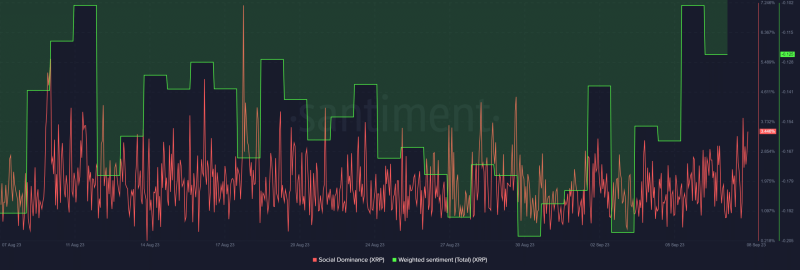

Despite the lack of enthusiasm on XRP’s price front, on-chain data revealed that the market did respond to the acquisitions. Ripple’s social dominance achieved a slight upside in the last 24 hours likely in response to news regarding the recent acquisitions.

We also observed a surge in investor sentiment in the first week of September as evident by the uptick in the weighted sentiment. However, the improved sentiment did not convert into bullish momentum. This was likely because it failed to stimulate enough demand and volume to support a substantial price change.

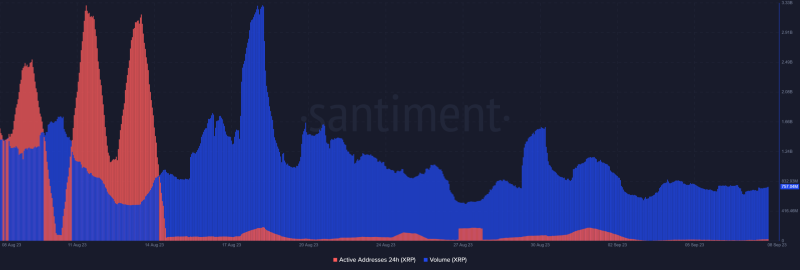

Furthermore, address activity was down to its lowest levels seen in the last four weeks. Meanwhile, on-chain volume remained relatively steady, indicating that the acquisition news did not trigger a short-term impact on XRP price and demand dynamics.