10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

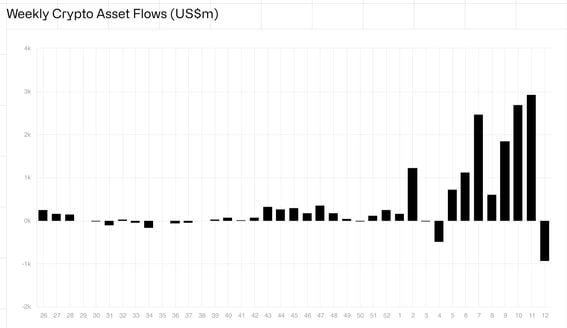

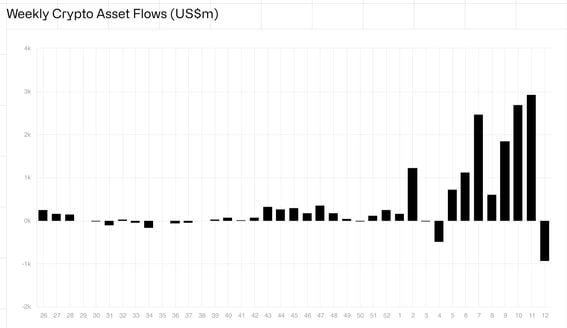

- The outflow last week totaled $942 million, according to a CoinShares report.

- Altcoins fared better last week, with $16 million of net inflows – notably into polkadot, avalanche and litecoin.

Digital asset investment products witnessed record weekly outflows last week after billions piled into the vehicles over the past few months.

Led by $2 billion in exits from the Grayscale Bitcoin Trust (GBTC), last week’s crypto fund outflows totaled $942 million, according to CoinShares. This broke what had been a record seven-week string of inflows of $12.3 billion.

Last week’s outflow came alongside downside volatility in the price of bitcoin (BTC), which tumbled below $61,000 from $73,000 just days earlier.

“We believe the recent price correction led to hesitancy from investors, leading to much lower inflows into new ETF issuers in the U.S., which saw $1.1 billion inflows,” said CoinShares. “Partially offsetting incumbent Grayscale’s significant $2 billion outflows last week.”

A Coinbase research report echoed CoinShares’ take, saying that the driver behind the surge in outflows was GBTC, noting one source of potential selling pressure from the bankruptcy estate of Genesis Global, which holds tens of millions of shares in the fund.

According to the CoinShares report, altcoins fared better last week, with $16 million of net inflows – notably into polkadot (DOT), avalanche (AVAX) and litecoin (LTC).

Edited by Stephen Alpher.