Michael Saylor-founded MicroStrategy disclosed it now holds 152,800 Bitcoin as of July 30, and is back in the black.

Business intelligence firm MicroStrategy — one of the largest corporate holders of Bitcoin (BTC) in the United States — managed to return to profitability in the second quarter amid a surge in the price of Bitcoin.

In a Q2 earnings results filing posted on Aug. 1, MicroStrategy reported $22.2 million in net income, a massive swing from a net loss of $1.1 billion in the prior-year period. Total revenues were mostly flat at $120.4 million.

In July, @MicroStrategy acquired an additional 467 BTC for $14.4 million and now holds 152,800 BTC. Please join us at 5pm ET as we discuss our Q2 2023 financial results and answer questions about the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/SCHeBJ80TH

— Michael Saylor⚡️ (@saylor) August 1, 2023

Much of the swing was due to a comparatively smaller digital asset impairment loss of $24.1 million in the quarter, compared to a whopping $917.8 million in Q2 2022.

In MicroStrategy’s case, digital asset impairment occurs when the market price of Bitcoin falls below the price at which the Bitcoin was acquired.

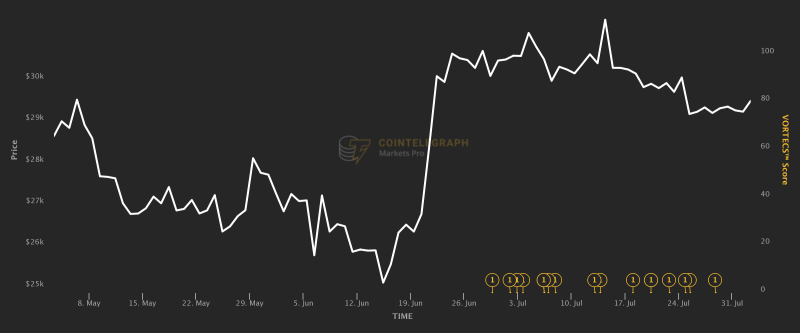

The price of Bitcoin hovered between $25,000 and $30,700 in the second quarter, with a notable rally in mid-June after several new spot Bitcoin exchange-traded funds were filed to the Securities and Exchange Commission.

“Our bitcoin holdings increased to 152,800 bitcoins as of July 31, 2023, with the addition in the second quarter of 12,333 bitcoins being the largest increase in a single quarter since Q2 2021,” said MicroStrategy CFO Andrew Kang.

Kang said it used cash from operations to add more Bitcoin to its balance sheet, and did so against the “promising backdrop” of institutional interest, accounting transparency and increasing regulatory clarity for Bitcoin.

In a June 13 interview with Bloomberg, MicroStrategy chairman Michael Saylor said he believes recent enforcement actions from the Securities and Exchange Commission would eventually play out in favor of Bitcoin — the only crypto excluded from being a security by SEC Chair Gary Gensler.

#Bitcoin is clarity in a sea of Crypto chaos. pic.twitter.com/4MMpZS3Bd0

— Michael Saylor⚡️ (@saylor) August 1, 2023

The company acquired 12,333 Bitcoin for $347 million in the quarter. As of July 30, the firm bought another 467 BTC, meaning its total Bitcoin balance is worth $4.5 billion at current prices.

In a separate filing to the SEC, also filed on Aug. 1, the company revealed it is also planning to sell up to $750 million in stocks for the acquisition of Bitcoin and other general corporate purposes.

The price of Bitcoin has continued to creep upwards over 2023, surging 79% since the start of the year. It is currently trading at $29,206.80, according to Google Finance.

MicroStrategy’s share price has also witnessed a resurgence per Google Finance, starting at $145.02 per share on Jan. 3, and rising nearly 200% to $434.98 at the time of writing.

In July, analysts from New York-based investment firm Berenberg Capital posted a bullish outlook for MicroStrategy, noting that the upcoming Bitcoin halving rally could see its shares gain significantly in price.