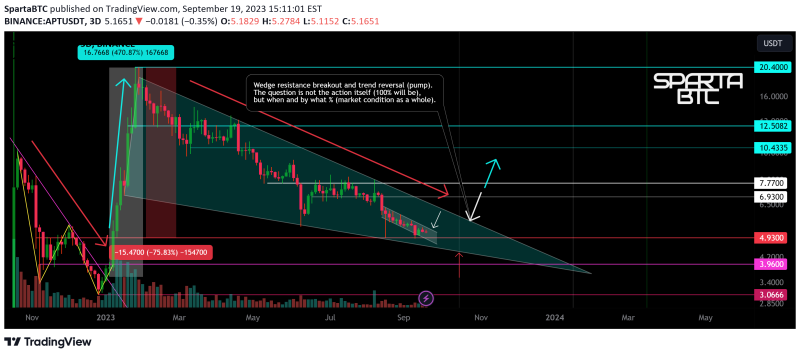

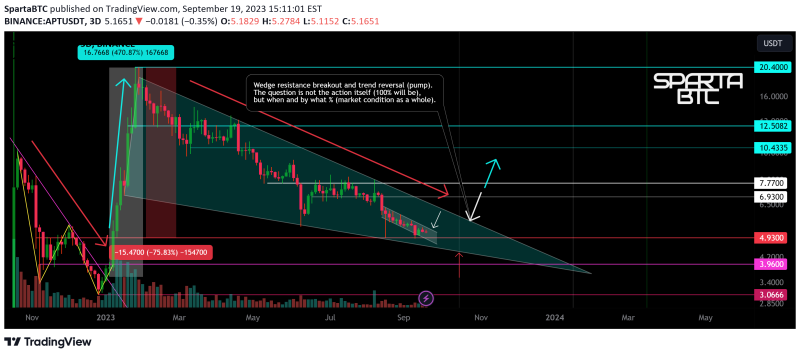

Logarithm. Timeframe 3 days. It is forming, as on many mid-liquidity altcoins—a descending wedge.

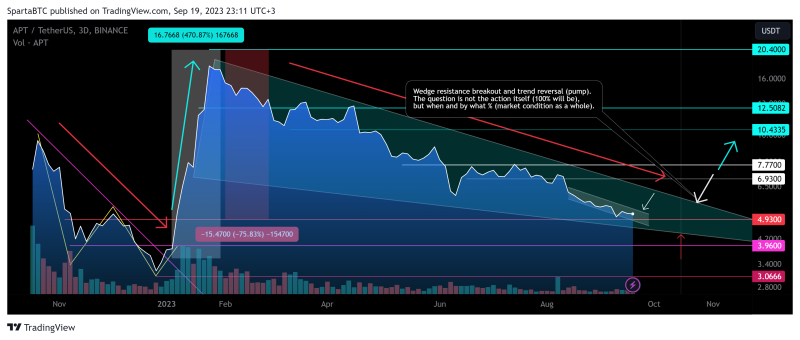

Here’s what it looks like on a line price chart.

Pivot Zones. Trading Strategies..

At the moment, the drop is -76%. Usually assets of this liquidity fall by -90%, but perhaps now is not the time yet or there is too much hype for cryptocurrency. You can work from the average set/reset price, i.e. allocate money in advance. Another option is to wait for the breakdown of the wedge.

Risk and mani-management.

Remember that with the general market situation, localized takeouts (squeezes) of stop-losses are possible. More globally, do not rule out the possibility of a so-called “black swan” (not a crypto story) since 03 2020 at the dumping of the crown virus. Then the descending wedge can break with one stick – squeeze (like the whole market), and no matter how beautiful the chart of this cryptocurrency looked earlier. If that happens, only buy with a net of orders and disconnect from media news scaremongering.

Scare and save, this is the essence of wolves earning money and loss of funds of illusorily scared and then saved sheep..

In any case, the descending wedge has been formed (bullish formation), breaking through its resistance (breaking the downtrend) is a matter of time, not the action itself. Moreover, this very HYIP and something “valuable” should be sold (create HYIP and media demand) to those who do not appreciate such things and do not divide cryptocurrencies into good and bad, because they are just tools with the help of which “out of nothing” you can make fabulous money on the faith of fools in something abstract.

Do not catch the lows and highs of the trend. Work logic like the big market participants:

“I never know the exact future, but there is a more likely or less likely scenario, those are the ones I stick to. I am prepared for any localized outcome of events, even the less likely”. Absolutely not interested in crypto news and majority opinion”.