The agency will brook no deviation from the “Travel Rule,” which mandates the sharing of detailed information about parties on both sides of a crypto transaction. The FCA is no outlier on this issue, but has set forth its guidelines partly under the influence of the US Financial Action Task Force (FATF).

The FCA Wants to Stop Crypto Money Laundering in Its Tracks

An official notice posted on the FCA’s website on Thursday, and updated on Friday, sets September 1, 2023, as the travel rule compliance deadline. From that date on, it states, UK crypto firms must “collect, verify, and share information about cryptoasset transfers.”

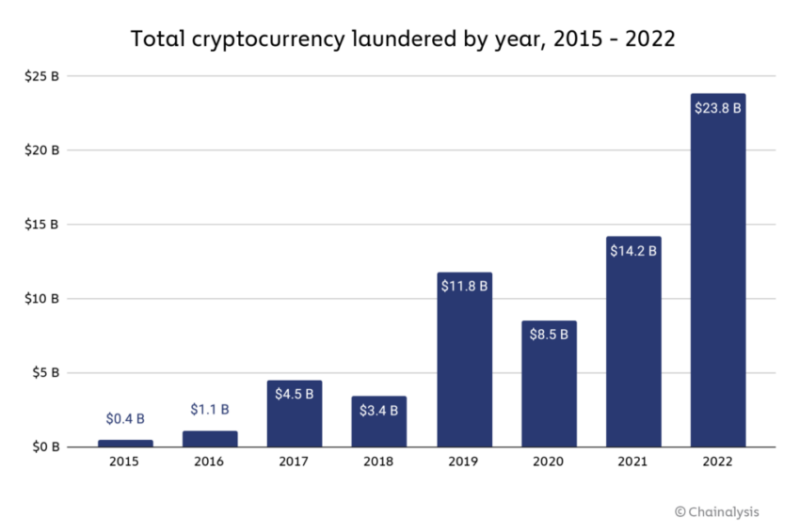

The regulator seeks to curb the high levels of illicit activity with which cryptocurrency, sadly, is still associated. And, from the FCA’s standpoint, this goal requires more probity on the part of crypto firms. They must do more to ensure they are not doing deals with money launderers and other bad actors.

To this end, the FCA goes beyond the requirement spelled out above and lists a number of guidelines for firms undertaking trades and transfers of crypto. They must “take all reasonable steps and exercise all due diligence” around Travel Rule compliance.

Moreover, firms are responsible for such compliance even on the part of third-party entities that play a role in transactions. No one will be able to get off the hook by saying: “We can’t control who our counterparty does business with.”

In addition, the requirement goes beyond transactions in the United Kingdom. It includes other countries that are party to the Travel Rule. And firms will need to review the status of Travel Rule adoption in those parts of the world where they seek to do business.

The FCA holds out hope that cryptoasset firms can help curb soaring rates of money laundering through strict adherence to the Travel Rule. Source: Chainalsis.

The FCA Hopes for Broader Travel Rule Adoption

The regulator’s announcement includes further provisions that aim to promote transparency and fair dealing. It does not explicitly ban transactions with parties in places that do not have a Travel Rule in effect.

However, in such cases, firms must do as much as they can to share and receive information. And to make sure that the prospective counterparty is on the level. The FCA’s notice states:

“If the firm cannot receive the necessary information, the UK cryptoasset business must still collect and verify the information as required by the Money Laundering Regulations (MLR) and should store that information before making the cryptoasset transfer.”

If not all information is forthcoming, that is a red flag. In such cases, the FCA requires firms to undertake risk assessments. They must think long and hard about whether to go ahead.

“We will keep our expectations under regular review as global adoption of the Travel Rule develops,” the notice concludes.

The industry has had enough of money laundering and of bad actors. The FCA’s goals, as set forth in this latest notice, might sound noble.

Yet some may wonder whether the FCA is struggling to improve its image. Especially after a recent Censuswide survey finding that a majority of UK crypto firms think poorly of the job the FCA is doing.