Ethereum’s number of long-term holders surpassed that of Bitcoin for the second time ever.

- Investors at large were accumulating ETH while its price remained low.

- Though confidence was high, market indicators remained bearish on ETH.

As we bid adieu to 2023, Ethereum [ETH], the king of altcoins, made remarkable moves in a bid to outshine the king of cryptos, Bitcoin [BTC].

A recent development signified increased confidence among investors in ETH at a time when Bitcoin awaits a major event. Does this mean that Ethereum will earn investors profits in 2024?

Long-term holders are confident in Ethereum

As per the latest tweet from IntoTheBlock, Ethereum recently flipped Bitcoin in a key metric. To be precise, Ethereum’s total number of long-term holders [LTHs] surpassed that of Bitcoin for the second time ever.

This reflected investors’ faith in ETH, showing that they expected the altcoin to surge in the coming year.

2023 Review! This year, the percent of long-term $ETH holders surpassed that of Bitcoin for the second time ever! pic.twitter.com/i6kDzAjzgM

— IntoTheBlock (@intotheblock) December 30, 2023

It was interesting to note that while ETH overtook Bitcoin in terms of LTHs, the average holding time of Bitcoin was around four years, while Cardano’s [ADA] was less than a year, as reported earlier by AMBCrypto.

To see whether long-term holders’ mindsets affected retail investors’ behavior, AMBCrypto checked Santiment’s data.

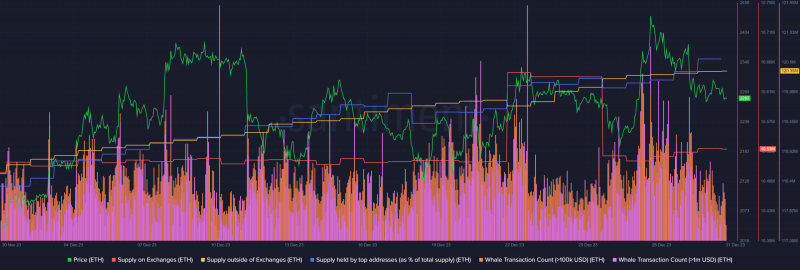

Our analysis found that the market at large was showing faith in ETH as it continued to stockpile. ETH’s Supply on Exchanges witnessed a drop in the recent past, while its Supply outside of Exchanges rose consistently.

The fact that investors were buying ETH was further proven by AMBCrypto’s analysis of CryptoQuant’s data, as ETH’s exchange reserve was decreasing at press time.

Whale activity around Ethereum also remained high throughout the last month, as evident from the rise in its whale transaction count. In fact, whales were shown to be buying Ethereum, as the altcoin’s supply held by top addresses shot up.

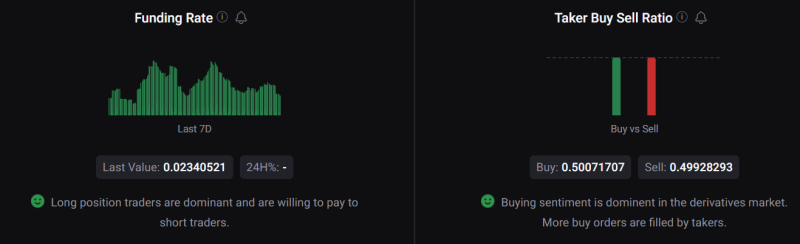

Things on the derivatives side also looked optimistic, as its Taker Buy Sell Ratio was green. This meant that buying sentiment was dominant in the Futures market.

The coin’s Funding Rate also remained high, meaning that the derivatives investors were actively buying ETH at press time.

2024 to be bullish for Ethereum?

However, despite investors’ attempts to stockpile ETH, the token’s price action turned bearish during the concluding days of 2023. According to CoinMarketCap, ETH was down by nearly 1% in the last 24 hours.

At the time of writing, ETH was trading at $2,283.21 with a market capitalization of over $274 billion.

To see whether Ethereum would begin 2024 with a bull rally, AMBCrypto took a look at its daily chart. Our analysis found that investor confidence in ETH might take time to reflect on its price, as the MACD displayed a bearish crossover at press time.

Its Relative Strength Index (RSI) also moved downward, suggesting a slight price drop in the near term.