In a September 8 post on X (formerly Twitter), Emmer said the new bill would limit how Gary Gensler can weaponize taxpayers’ dollars against the emerging industry.

The New Bill Against the US SEC

The Emmer-sponsored appropriations amendment bill will restrict the SEC’s use of funding to bring enforcement cases against the crypto industry. Politico reported that this would tie the regulator’s hands until “clear rules and regulations” are in place.

“Gary Gensler abused his authority to grow the Administrative State to the detriment of the American people. Congress must use all our tools, including the appropriations process, to restrict Chair Gensler,” Emmer said.

It is worth noting that Emmer did not provide details of when the bill would be submitted to Congress.

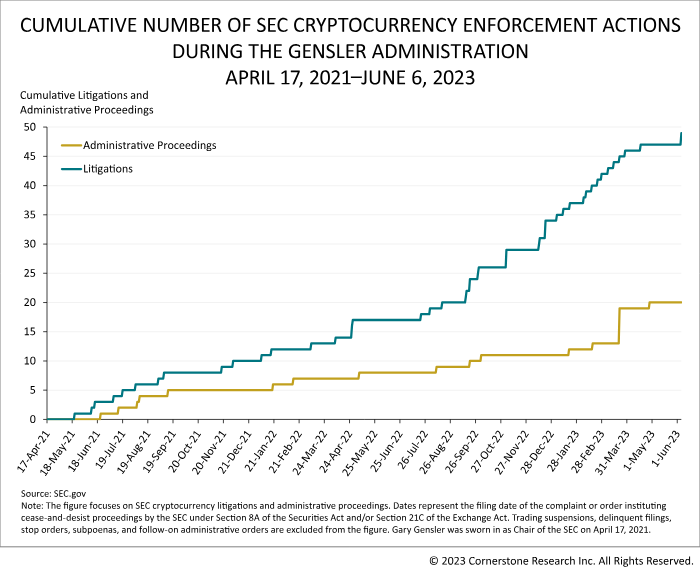

SEC Enforcement Actions Under Chair Gensler. Source: Cornerstone Research

Earlier this year, Gensler defended the agency’s budget request of $2.4 billion for the next fiscal year, up from the $2.1 billion it requested in 2022. The SEC chair argued that this additional funding would help the federal agency keep up with the pace of innovation.

Under Gensler, the SEC has brought several enforcement actions against major crypto-related firms, including Coinbase and Binance.

Emmer Has a Pro-Crypto History

Meanwhile, the intention behind Emmer’s latest move should not surprise anyone, given his strong advocacy for the cryptocurrency sector. Emmer has been a vocal proponent of various pro-crypto bills, such as the Blockchain Regulatory Certainty Act introduced in March.

This bill aimed to create a clear distinction between blockchain developers, service providers, custody providers, and money transmitters. Additionally, Emmer supported the SEC’s Stabilization Act, championed by fellow Republican Warren Davidson, which aims to oust Gensler from his current position.

It is worth noting that none of these bills have made significant progress, and the new proposed amendment could face a similar fate. The likelihood of Democratic lawmakers endorsing amendments that potentially curtail the SEC’s authority appears slim.

The SEC has recently encountered numerous challenges in asserting authority over the emerging sector. Notably, it faced setbacks with the partial loss in the Ripple case and a US Appeals Court ruling that deemed its rejection of Grayscale’s bid to convert its Bitcoin Trust into a spot ETF as arbitrary.

Nonetheless, the SEC intends to appeal the Ripple ruling and is currently deliberating its stance on the Grayscale decision.