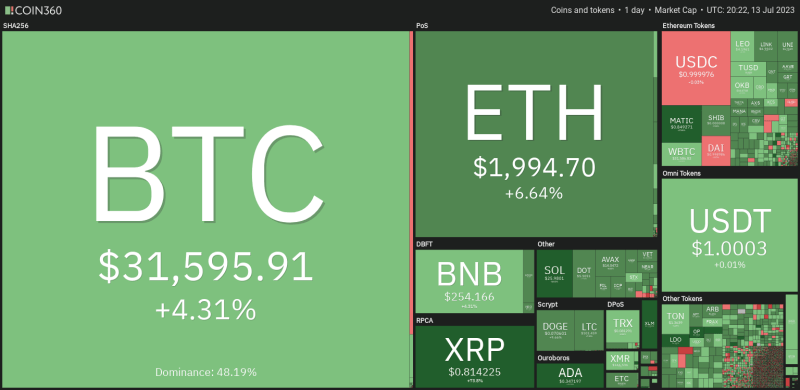

The crypto market is up today as Bitcoin price hit a new year-to-date high and Ripple’s victory against the SEC appears to lift the entire market.

The crypto market is up today as Bitcoin (BTC), Ether (ETH), XRP (XRP), Cardano (ADA) and numerous altcoins rallied after a United States Federal District Judge ruled that XRP is not a security.

XRP price led the rally on July 13, reaching a 1-year high of $0.93 and gaining over 75% on the day. Bitcoin price reached above the year-to-date high of $31,800, while Stellar (XLM), which is similar to XRP rallied over 67% to hit a near 9-month high above $0.19.

Let’s examine three of the major factors influencing today’s crypto market rally.

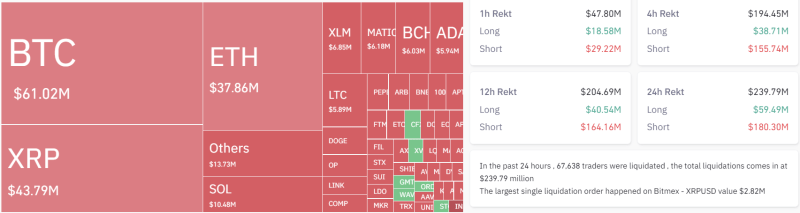

Crypto liquidations rule the day

Today’s rally fueled a wave of short position liquidations across the market, totaling over $180 million in 24-hours. XRP short liquidations lead the way with the largest single liquidation of $2.8 million in one transaction on BitMex exchange. In total, $27.3 million in XRP shorts have been liquidated in 24-hours.

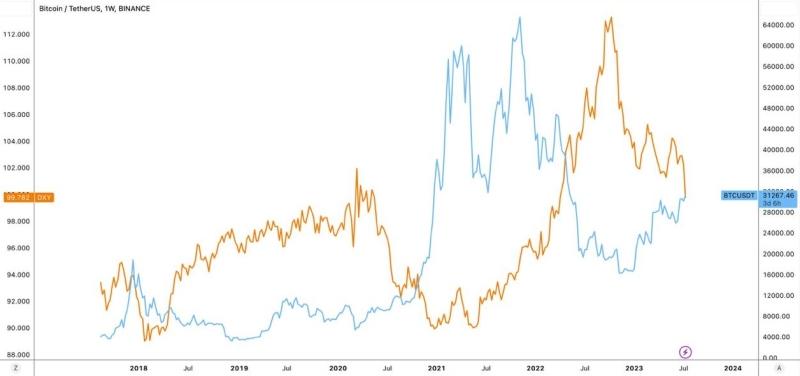

The US dollar index (DXY) continues to cool off

Another positive sign for crypto market prices is the cooling U.S. dollar index (DXY). Historically when the DXY index retracts, sentiment for risk assets like Bitcoin increases.

The DXY may continue cooling after CPI data showed the smallest 12-month jump since March 2021. In a perfect world, investors would ideally view a retracting DXY as a reason to increase sentiment for risk assets like cryptocurrencies.

DXY’s pullback has been in lockstep with a return to form for Bitcoin and altcoins. Historically, a cooling DXY is followed by Bitcoin price and crypto markets moving in the opposite direction.

The Bitcoin ETF buzz

Previous speculations around the potential for the first Bitcoin ETF approval in the U.S. helped the crypto market but the hopium had somewhat waned since the rush of filings in early July. Some analysts think that the recent victory by Ripple Labs against the SEC may make it more difficult for Chairman Gary Gensler to reject the current round of Bitcoin ETF applications.

Galaxy Digital founder, Mike Novogratz believes approval of a spot Bitcoin ETF would essentially be a government seal of approval for Bitcoin.

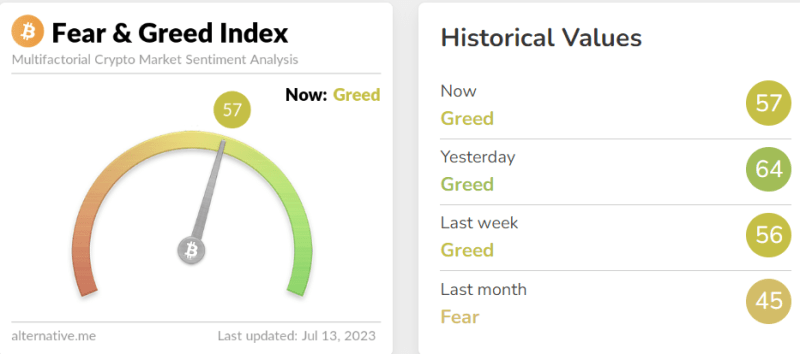

While Bitcoin and altcoins still have risk events that can impact the price, the Bitcoin Fear & Greed Index is highlighting that investors are more apt to take on risk assets.

Overall, crypto markets are likely to continue seeing price volatility. While the positive news of Ripple Labs’ victory against the SEC is providing a nice short-term bump in crypto prices, the market’s reaction to any new enforcement actions or an economic recession will be the true determinant of the direction the market chooses to take.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.