Contents

XRP whale movements and market activity suggest an imminent breakout, with bullish sentiment prevailing.

Edited By: Saman Waris

- XRP whale activity and active addresses point to rising market interest.

- Exchange reserves and long/short ratio reflect mixed trader sentiment.

Ripple [XRP] has gained significant market attention, with a series of whale transactions sparking speculation about the token’s next move.

Key on-chain metrics suggest growing market activity, leaving traders to wonder if XRP is on the verge of a significant price shift.

The latest whale activity and other important indicators suggest that XRP could be at a turning point.

Whales unlock massive amounts

According to Whale Alert, more than 1 billion XRP was unlocked from escrow across several whale transactions, valued at over $621 million.

This large movement has prompted concerns about potential market volatility.

At press time, XRP trades at $0.6294, reflecting a slight 0.21% dip over the past 24 hours. Therefore, these transactions may signal an upcoming price change.

However, whether this leads to a sell-off or more accumulation remains unclear.

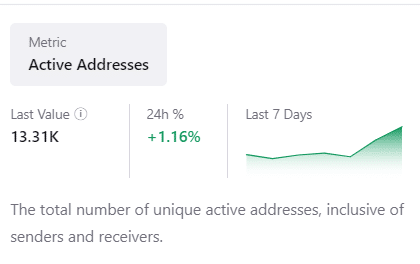

XRP’s active addresses have increased by 1.16% over the last 24 hours, now totaling 13.31K at press time. This steady rise suggests a growing number of users engaging with the network.

Additionally, active address growth typically aligns with increased market interest.

Consequently, this metric could indicate that traders are positioning themselves ahead of potential price action. Therefore, the uptick in active addresses supports a potential upward trend in XRP’s market activity.

Exchange reserves hint at rising selling pressure

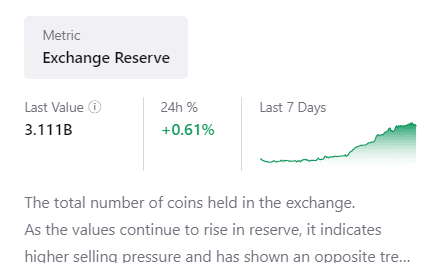

However, XRP’s exchange reserves have increased by 0.61%, reaching 3.111 billion XRP. This rise in reserves often signals potential selling pressure, as more tokens are transferred to exchanges for possible liquidation.

Consequently, this could indicate that some traders are anticipating a short-term pullback, despite the overall bullish sentiment.

Therefore, while growing active addresses reflect interest, the increased reserves suggest caution.

Trader confidence rises

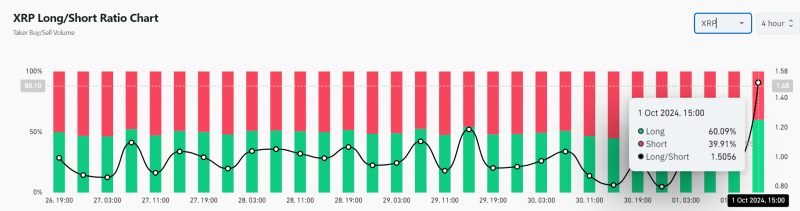

Additionally, the long/short ratio for XRP reveals that 60.09% of traders hold long positions, compared to 39.91% short. This 1.5056 long/short ratio reflects confidence that XRP will continue its upward momentum.

However, with the slight bearish movement in price and increased exchange reserves, some caution is advised. Nonetheless, the overall sentiment is optimistic, which may drive XRP’s performance in the near future.

Read Ripple’s [XRP] Price Prediction 2024-25

Is a breakout likely?

Given the data, XRP is poised for a breakout. Whale activity, rising active addresses, and a bullish long/short ratio point to continued growth.

However, increased exchange reserves suggest short-term selling pressure. While there may be some volatility, XRP appears likely to move upward in the coming days. Traders should remain cautiously optimistic.