Shiba Inu might be on the cusp of a fresh bull rally, but a few things need to happen first.

Edited By: Jibin Mathew George

- Shiba Inu’s price declined by more than 12% in the last seven days

- Metrics and market indicators seemed bullish on SHIB’s charts

Shiba Inu [SHIB] has been underperforming for multiple days, as both its weekly and daily charts were red. However, investors mustn’t lose hope, as this bearish price action might just be a prelude to a massive bull rally ahead, one which can allow SHIB to hit new highs soon.

Shiba Inu is consolidating

CoinMarketCap’s data revealed that the memecoin witnessed a double-digit price decline of 12% in the last seven days. Its 24-hour chart also remained red as its price moved down marginally. At the time of writing, SHIB was trading at $0.00001795 with a market capitalization of over $10.58 billion.

AMBCrypto’s look at IntoTheBlock’s data revealed that only 52% of SHIB investors were in profit, which can be attributed to this latest price correction. However, there seemed to be more to the story as SHIB was consolidating inside a bullish pattern on the charts.

Our analysis also revealed that SHIB has been consolidating inside the pattern since the beginning of March. Since then, SHIB has been rejected twice from the upper limit of the falling wedge pattern.

At press time, the memecoin was testing its support on its chart. A successful test and a breakout could ignite a bull rally. If things fall into place, then SHIB might as well reclaim its March highs in the coming weeks or months.

Will SHIB begin a rally?

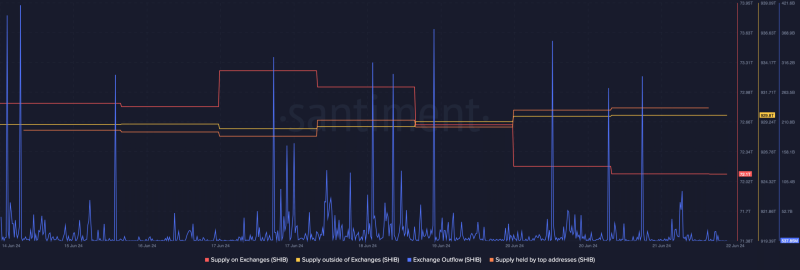

Since there seemed to be chances of a trend reversal, AMBCrypto analyzed SHIB’s on-chain data to see what the metrics suggested. As per our analysis, buying pressure on SHIB rose last week – Evidenced by the spikes in its exchange outflows. The fact that investors were buying SHIB was further proven by the rise in its supply outside of exchanges and a dip in its supply on exchanges.

Whales have also been actively buying the memecoin as the supply held by top addresses increased over the last few days.

There was better news too as at press time, SHIB’s fear and greed index had a value of 36%, meaning that the market was in a “fear” phase. Whenever the metric hits this level, it indicates that the chances of a price hike are high.

Finally, AMBCrypto’s analysis of SHIB’s daily chart revealed that its Relative Strength Index (RSI) was in the oversold zone.

The Chaikin Money Flow (CMF) registered an uptick, implying that investors might soon see SHIB paint its charts green. Nonetheless, the MACD continued to support the sellers as it projected a bearish advantage in the market.