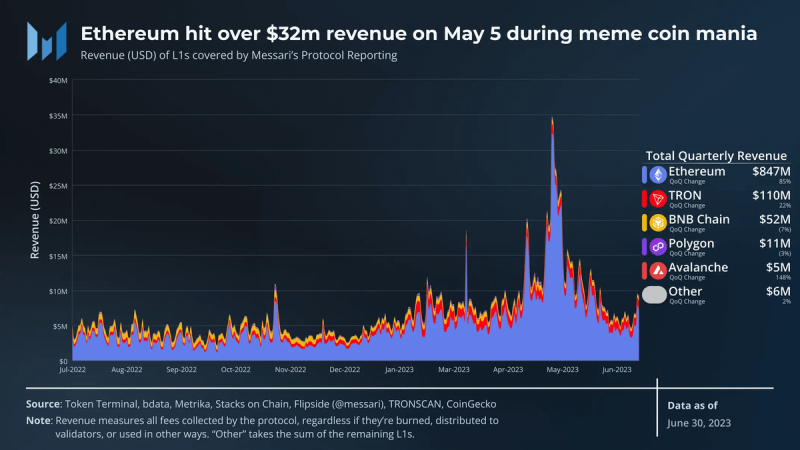

In the second quarter of 2023, the memecoin mania unleashed by the PEPE crypto led the layer1s Ethereum and Tron to record a surge in volumes and revenue, up sharply from the previous quarter.

Especially in May, Ethereum validators thanked crypto frog Pepe for creating the conditions for stellar revenues.

Let’s look at all the details together.

Ethereum and Tron top the list of most profitable L1s: Pepe crypto triggers volume boom

Blockchain research firm Messari highlighted how the memecoin mania triggered by the advent of the PEPE crypto created many benefits for Ethereum and Tron infrastructures during Q2 2023

The two blockchain networks saw their respective revenues increase especially during May, propelled by the large volumes generated on the DeFi platforms.

Overall, revenue from Ethereum and Tron validators reached 93% of all L1 industry revenue in the second quarter.

The amount of net fees recorded on Vitalik Buterin‘s chain grew 83% on a QoQ basis, peaking at $32 million on 5 May, at the height of the hype caused by the Pepe crypto.

In the four-month reporting period, competitors BNB Chain, Polygon, Avalanche and the other smaller chains achieved a total gain of $74 million, 11 times less than that of Ethereum.

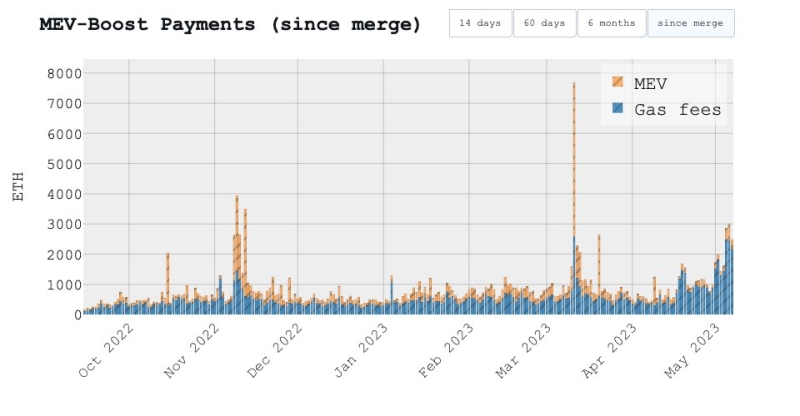

Also very interesting to note is that over the weekend of 6-7 May, the profits of validators reached 3,006.78 ETH, amounting to a counter value of $5.6 million, almost equal to what was recorded when the FTX exchange collapsed.

The flashboats dashboard shows how the gain was boosted enormously by MEV-boost payments, which in November 2022, during the exchange crash, came to 2,505.69 ETH, for a combined validators’ revenue of 3,929.68 ETH ($6.1 million).

In all of this, insiders validating transactions on the two networks thanked Pepe and the traders who traded it relentlessly on DEXs like Uniswap.

It is amazing to observe how the trend of a memecoin like the Pepe crypto has created such fertile ground that Tron and Ethereum have been able to achieve these numbers.

Also noteworthy is how during 6-7 May, about 600 ETH were burned through the memecoin, which is more than Coinbase, Optimism, or Blur generated individually.

Meme coins generating nice revenue for Ethereum.

Around $1.1m of eth burnt this week for Pepe alone. pic.twitter.com/JWpg1KLtGX

— Elie Steinbock (@elie2222) May 7, 2023

The general situation in the DeFi world

Let’s now try to broaden the horizon of analysis by looking at the overall situation of DeFi and the revenue it has generated so far, without focusing too much on Pepe or the individual Ethereum and Tron chains.

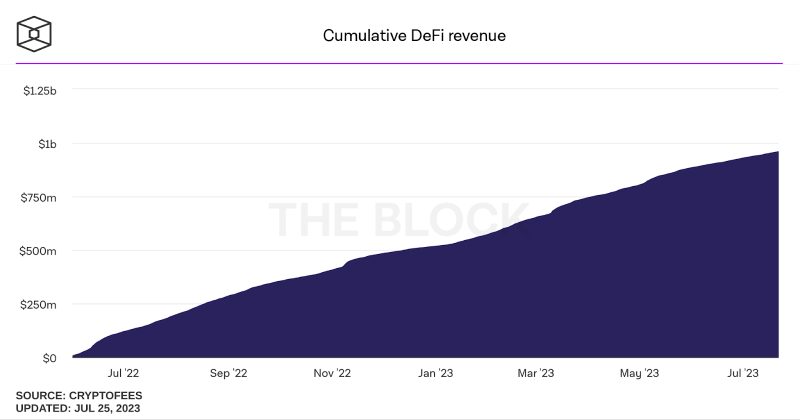

It is worth recalling that the decentralized finance sector, unlike the centralized counterpart run by cryptocurrency exchanges, is much younger and with a reduced history that sees the first results coming only in late 2020.

In just a few years, DeFi has grown a lot, both in terms of technologies and decentralized applications that can make sense of this industry, and in terms of volumes and revenue generated.

Currently the cumulative revenue of this financial environment is at $957 million, poised to reach the round figure of $1 billion by the end of the year.

Its success stems not from the advent of crypto memes like Pepe, but from the enthusiasm of libertarian movements and new generations who do not want to delegate ownership of their crypto assets to third-party infrastructures and prefer self custody and decentralized exchanges on chains like Ethereum and Tron.

Then again, if we think about it, it is absurd to think that Bitcoin and all other cryptocurrencies were born at the time to avoid financial intermediary situations, and then the same conditions with the spread of CEXs allowed the early years development of the industry.

DeFi basically aims to offer a world where financial services are untethered from central entities, in which users can preserve their privacy without offering their personal data to the first competitor.

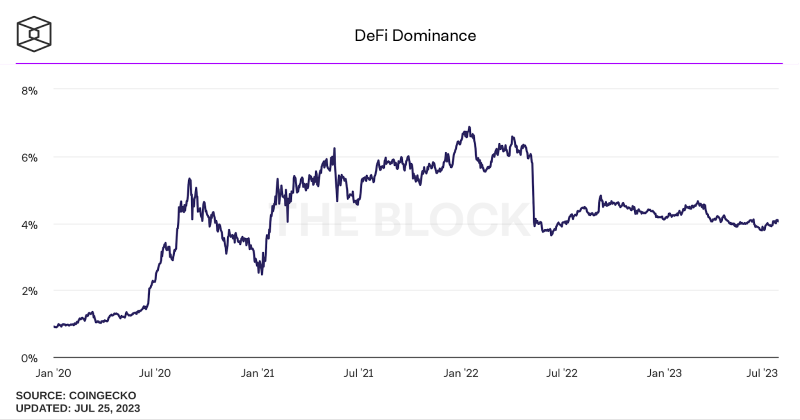

Unfortunately, however, the market share of decentralized finance compared to CEXs is still very low with a value that currently stands at about 4%.

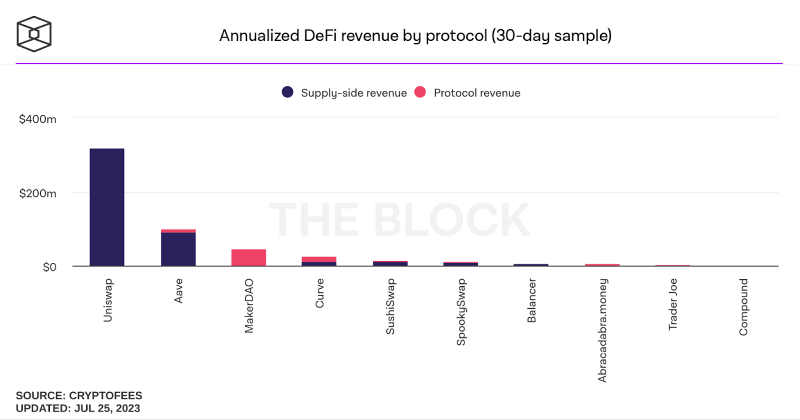

As for the most popular and most profitable protocols that populate the DeFi world we can mention the performance of Lido, Uniswap and MakerDAO, which generated fees of $52.18 mln $36.28 mln and $9.47mln in the last 30 days, respectively.

This is followed by projects such as Convex Finance, Aave, Gmx, Maestro, Blur, and Synthetix.

It is obvious how the Uniswap and Lido protocols represent the main benchmarks across the industry, with a respective TVL of $3.78bn and $14.67bn.

-This metric does not take into account liquid staking platforms such as Lido.