In this article we delve into the layer-2 blockchain of the Coinbase cryptocurrency exchange, BASE.

A few days ago it was launched on the mainnet officially opening its doors to the market.

The introduction of Base represents a turning point for the crypto world as it is the first decentralized blockchain solution developed by a Nasdaq-listed company.

Full details below.

What Base is and how it works: the layer-2 of the Coinbase cryptocurrency exchange

Base is a layer-2 scaling solution developed by cryptocurrency exchange Coinbase with a view to providing the Ethereum ecosystem with an alternative infrastructure for faster and cheaper operations.

Indeed, the network inherits the connotations of security and decentralization from Ethereum, while offering a suitable space to scale all the activities of the main layer.

Technically Base represents an “optimistic rollup” blockchain, in that user-initiated transactions are compressed and “wrapped” (hence the term rollup) in a batch and processed later on the main substrate.

All optimistic rollups use the technique of “zero-knowledge cryptographic proofs” to check whether all layer-2 transactions meet Ethereum’s parameters.

This approach, in addition to lightening the load on Vitalik Buterin‘s infrastructure, helps create an alternative ecosystem where users can enjoy a super-efficient decentralized network.

Base was built using the “OP Stack” software set that served to ensure a secure and cost-effective compatible EVM environment for developers.

In addition, during the development, Coinbase relied on the cybersecurity services company OpenZeppelin to cover the risk of smart contract hacks on the new network.

The notoriety of the platform, a leader for crypto exchanges in the United States, combined with the 110 million verified users and $80 billion circulating in the ecosystem will surely help Base emerge as one of the dominant layer-2s in the near future.

On 9 August, the blockchain officially landed on the mainnet, making history as the first decentralized layer-2 solution to ever be developed by a Nasdaq-listed company.

Speaking of the US markets, if traffic on Base becomes organic and consistent in the coming months/years, the parent company’s revenues could soar inducing bullish rises in the $COIN stock.

All the data after Base’s mainnet

Base, the layer-2 of Coinbase, has been posting noteworthy numbers immediately after the blockchain was opened to the public with the mainnet launch on 9 August.

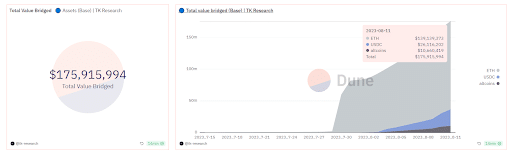

In just a few days, more than 75,000 ETH have been bridged from the Ethereum network, worth about $140 million, as well as another $35 million in USDC and altcoins (Dune data).

Altogether, the total transferred to Base amounts to $175 million and could easily grow to $1 billion in a short time.

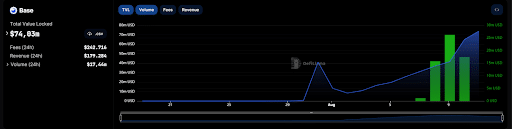

Of all the capital bridged to Coinbase’s layer-2, about 42%, equivalent to $74.83 million, was locked into the smart contracts of the various decentralized applications in the Base ecosystem.

This is still a low TVL compared to major crypto networks in the web3 landscape, but at the same time it represents a significant target when compared to the recent emergence of the infrastructure.

The main dApps present on Base are BaseSwap, Stargate, Sushiswap, Beefy, SwapBased, RocketSwap Base, Overnight Finance, Balancer, Uniswap, KokonutSwap, SynthSwap, and DackieSwap.There were also good numbers on the volume front with a record $26 million touched on 9 August.

Since its mainnet launch, Base has already validated about 2.5 million blocks and handled 7.5 million transactions, showing strong public interest in Coinbase’s product.

It is worth noting that 850 ETH in gas fees have already been paid in a short time: on average, each user has paid 0.0001812 ETH per transaction, for a counter value of $0.33.

This is a significantly lower cost than Ethereum, which currently charges $1.80 for an ERC-20 transfer and $6.13 for a swap on Uniswap (the price of gas these days is very low by the way).

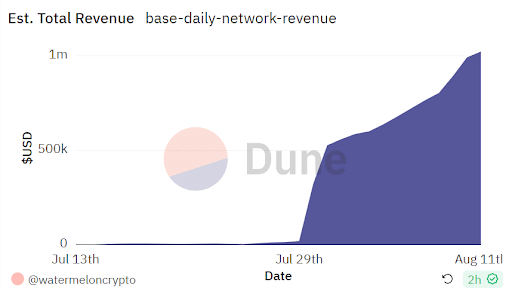

Overall Base has already collected more than $1 million as revenue from transaction fees, with that figure set to increase given the hype of the moment and the popularity of Coinbase.

So far, about 450 thousand users have interacted with the crypto network’s variety of applications, contributing to the chain’s initial success.