Market participants are eagerly waiting for a bullish or bearish breakout for BTC. Interest shown by TradFi giants was responsible for the last big rally.

- Bitcoin’s lackluster performance in recent months prompted miners to HODL

- Miner liquidations occur on a regular basis and should not be seen as an anomaly

After a prolonged HODLing period, Bitcoin [BTC] miners finally decided to liquidate a significant chunk of their holdings.

In fact, according to data from CryptoQuant, miners offloaded more than 900 million Bitcoins from their bag in the last two days, worth $26 million at the time of writing.

Large sell-offs are typically viewed as a bearish occurrence for the crypto-asset since they flood the market with more supply. However, miner liquidations occur on a regular basis and should not be seen as an anomaly.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Miners run out of patience

Miners are responsible for creating new BTC tokens and bringing them into circulation. While they are rewarded in BTC for their efforts, they require cash to cover mining expenditures such as machinery, power, and rentals.

An earlier article by AMBCrypto highlighted how this frequent process was disrupted due to Bitcoin’s lackluster performance over the last month and a half.

The king coin has failed to break out of a tight trading range since mid-June, as per CoinMarketCap. The problem has compounded in August, as the leading cryptocurrency has struggled to break past even the $30,000-level.

In the absence of any meaningful price hike, miners went into a hoarding mentality for a change and decided to wait for the next move up. However, as seen earlier, their patience eventually ran out and they decided to settle for the reduced returns.

Revenue on a sharp decline

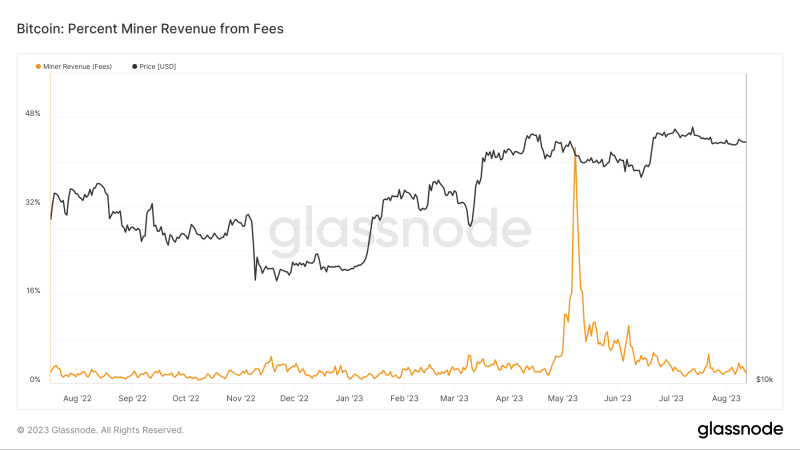

Miners’ nervousness could be gauged by their rapidly shrinking earnings. Miner incentives are made up of two components – Block rewards and transaction fees. Block rewards are fixed, and miners factor them into their budgeting.

However, transaction fees are variable which ultimately impact their earnings. Since hitting all-time high levels in early May, the revenue earned through fees has steadily dropped. Here again, blame Bitcoin’s protracted lull in volatility.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Market waits for the next big move

Market participants are eagerly waiting for a bullish or bearish breakout for BTC. Interest shown by TradFi giants was responsible for the last big rally in June. However, the next move will probably depend on the SEC’s response to a flurry of spot Bitcoin exchange traded funds (ETFs).

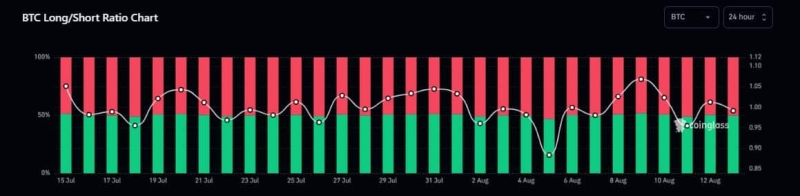

In the derivatives market, the sentiment shifted in the favor of bulls. In fact, according to Coinglass, the Longs/Shorts ratio was greater than one on August 12, indicating the dominance of traders gunning for price gains.