Usage of SHIB has increased since the Shibarium development team provided an update. Here’s what else you can expect now…

- Shibarium Mainnet has reached the third stage of its roadmap

- Shiba Inu’s active addresses, open interest, and network growth increased

After months of anticipation, Shibarium, the upcoming Layer Two (L2) blockchain of Shiba Inu [SHIB], might soon be launched on the Mainnet. This information was disclosed by NOWNodes, one of the development arms involved in the project.

Only moments left

According to NOWNodes, the Mainnet was already in the third phase of the Shibarium Roadmap. The tweet also revealed that once some of the conditions are met, it would announce the integration of the Shibarium RPC nodes.

RPC nodes is an acronym for Remote Procedure Call nodes. They are used to enable users to read data on blockchains and send transactions on different networks.

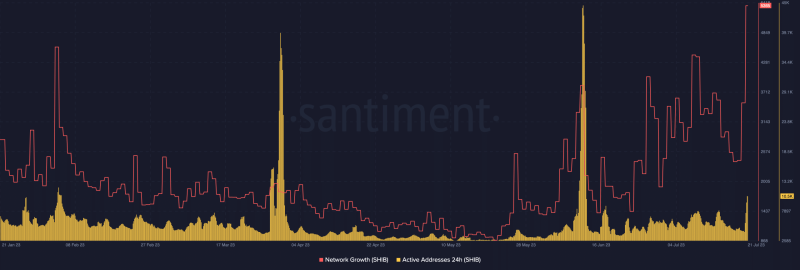

Following the disclosure, on-chain data showed that SHIB’s network growth spiked. At press time, the network growth had increased to 5,365. Here, network growth measures the number of new addresses interacting with a network.

When the metric rises, it means that a lot of new addresses transacted on the network. But when it falls, it means new cohorts refrained from exchanging between wallets.

Ergo, the hike in SHIB’s network revealed that adoption has risen. This was also reflected on the active addresses front.

Increasing traction and interest

Active addresses serve as a good indicator of daily users transacting on a particular blockchain. At the time of writing, SHIB’s 24-hour active addresses had increased to 10,500. This cites an increase in participation in successful transactions via the Shiba Inu network.

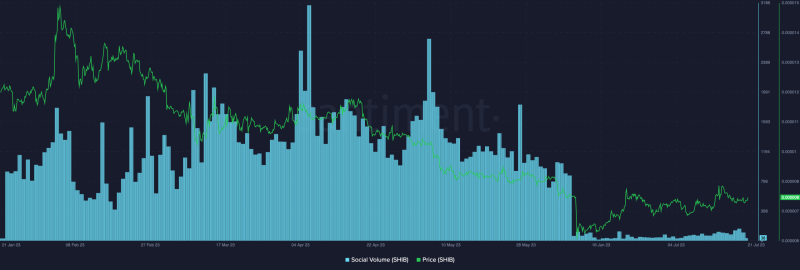

Despite the traction SHIB had, social volume remained in an uninspired state. At press time, Santiment revealed that the social volume was down to 38.

Social volume shows the total number of texts or search terms connected to an asset. When the metric is low, it means that there has been less relevant content linked to the asset.

However, when the social volume is high, it means unique mentions of the token are high. SHIB’s case was the former since the metric fell.

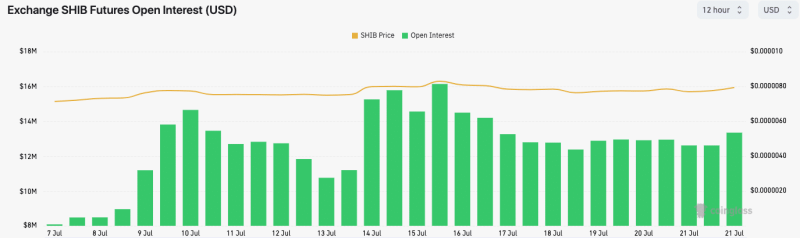

Furthermore, SHIB’s Open Interest (OI) also hiked. As an indicator used to track activities in the derivatives market, the OI is the total number of Futures contracts held by market participants.

The indicator is used to measure the market sentiment and strength behind the price. A decrease in Open Interest means that liquidity coming into the market has fallen.

On the contrary, when the indicator rises as SHIB did, then it suggests higher liquidity. Thus, if, the OI sustains the hike, then SHIB’s price might be positively affected.