CRYPTO LOOKING FOR A LIFT

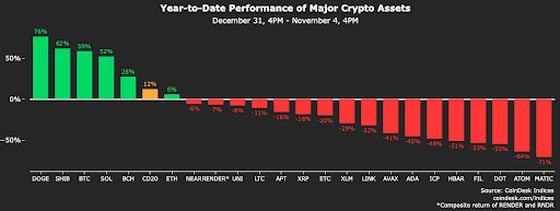

Crypto is hoping for an post-election lift, because it’s been an ugly year for most major crypto assets so far. The CoinDesk 20 — an index of the top 20 cryptocurrencies by market capitalization, excluding stablecoins and exchange tokens — is up 12% on the year, that’s mostly thanks to bitcoin (BTC), which has gained 59%. Bitcoin is weighed at 31% in the index, while ether (ETH) is worth 20%. The fact that these two assets are up year-to-date means that the bloodbath suffered by most of the other cryptocurrencies in the index has been somewhat concealed.

Unmute

01:35Why Bitcoin Will Be the Winner Regardless of U.S. Election Results

02:25DOGE Surges on U.S. Election Day; Bitcoin ETFs Shed $541M and Mt. Gox Moves $2.2B BTC

18:56Election Night Insights: Prediction Markets Don't Tell the 'Full Story,' Mark Connors Says

01:09U.S. Recession Signal Flares From 10-Year and 3-Month Yield Spread

Polygon (MATIC) has plunged 71% since the start of the year, despite the breakout success of betting website Polymarket, which is hosted on the blockchain. Cosmos (ATOM), polkadot (DOT) and avalanche (AVAX) — smart contract platforms that rose to prominence in 2021 — also performed badly, down 64%, 55%, and 41% each. Ether, of course, has disappointed expectations despite gaining its own spot exchange-traded funds, but at least the coin is up 6%.

The real winner of the year is dogecoin (DOGE), up 76% since December. It’s worth noting that the original memecoin put in most of that performance in the last couple of months; the coin began rising in early September alongside bitcoin and former President Donald Trump’s odds on Polymarket, just as Tesla creator Elon Musk ramped up his efforts to help Trump get re-elected.

FAIRSHAKE HAS MOVED ON TO 2026

If the crypto sector enjoys what Fairshake did with its mountain of money, the firms will probably like 2026, too. Of the $169 million raised in this cycle, officials of those affiliated political action committees said about $30 million was left over for the next congressional elections.

That $30 million paired with another $25 million promised from Coinbase Inc. (COIN) and a $23 million commitment from a16z — both said to be planned for the opening of the next cycle — will start the industry PAC off with a whopping $78 million for an election cycle that doesn’t even include a presidential race. The campaign-finance dominance from the crypto industry is only just beginning with Fairshake’s 2024 performance, it seems. Starting with the GMI PAC in 2022, the sector has a definite strategy toward a crypto-friendly U.S. Congress.

WHAT THE BIGGEST TRADERS ON POLYMARKET SAY

Flip Pidot, co-founder and CEO of American Civics Exchange, an over-the-counter dealer in political futures contracts … “curated a list of the top performing traders on Polymarket and built an electoral college forecast based on their bets alone. As of mid-afternoon Tuesday in New York, this “elite” model projects Harris will win 276-251, whereas Polymarket as a whole sees Trump winning 287-262.

DIVIDED CONGRESS MAY BE … GOOD?

The best way to get a good crypto bill at this point — meaning one that will last and stand up to party politics — would be if the chambers of Congress remained divided, as they are now, argued Jaret Seiberg, a longtime financial policy analyst in Washington.

“Divided government is likely the most important outcome for crypto as we believe that is what produces a bipartisan regulatory structure that will remain intact regardless of what happens in future elections,” he wrote in a note for TD Cowen clients. In this session that’s winding down, the Senate has been controlled (barely) by Democrats, and the House had a very narrow majority in the House of Representatives, leaving the two chambers in divided hands. Crypto legislation did manage to wind its way through the House for the first time, but it made no real progress in the Senate. If it had, it would have required a carefully negotiated compromise.

“That matters as we see policy stability as critical to the further development of the crypto sector,” Seiberg argued. A bill driven entirely by one side of the aisle becomes an easy target when the tables turn.

FINAL OUTCOME OF 2024 POLLING IS A SHRUG

Two of the most prominent U.S. polling-analysis operations – 538 and Nate Silver’s Silver Bulletin — based in similar statistical and political modeling, both concluded after careful study that the outcome of the presidential election is … a total mystery. Both operations suggested Vice President Kamala Harris has an advantage so slight that it’s laughably unhelpful in the polling world, in which margins of error knock any meaning out of such a tight conclusion.

In a hundred election simulations run by 538, stirring in the witches brew of battleground analysis and economic conditions, she wins 50 matchups to former President Donald Trump’s 49. The other goes to an electoral-college tie, which favors Trump. In most scenarios, Harris easily wins the popular vote — an outcome without political meaning, thanks to the U.S.’s electoral-college approach to the election.

Nate Silver’s own secret sauce, he needed to stretch the decimal places to indicate the distinction: Of 80,000 final simulations run by his site, Harris won 50.015% of the time, to Trump’s 49.985%.

All seven battleground states have been so close that they’re within the polling’s margins of error, as well, leaving this closely examined contest a genuine coin toss, according to the analytical gurus.

FAIRSHAKE SET UP FOR A HAPPY ELECTION NIGHT

Crypto’s campaign-finance arm Fairshake drew so much attention in the 2024 elections, and for good reason, since the industry dominated the political donations scene with its $169 million war chest. But the Fairshake political action committee and its affiliate PACs — backed mostly by crypto firms including Coinbase, Ripple and a16z — devoted their spending to congressional races only, choosing not to get into the presidential contest. The outcome: The effort is almost guaranteed to pay off with at least a couple of dozen new members of Congress that crypto dollars helped into Washington.

And Fairshake made a careful division of its party giving (managing to anger both sides in the process). Its final list of 58 congressional candidates the groups supported included 30 Democrats and 28 Republicans. Many of those were already incumbents and crypto allies, but the PACs pursued a strategy during the primaries to help elevate crypto-friendly winners in districts in which their candidate’s party was strongly favored to win in the general. That way, the general election is meant to be a night of victorious news.

The same strategy worked for its earlier iteration, GMI, in the 2022 congressional elections.

CRYPTO’S OHIO RISK

Crypto PAC Fairshake’s biggest focus was in Ohio, where the PACs dedicated tens of millions to sink crypto skeptic Sherrod Brown, the state’s longtime Democratic senator, and lift blockchain entrepreneur Bernie Moreno, a Republican.

The industry arm took a controversial risk with this one. Sherrod Brown is the chairman of the Senate Banking Committee, which will likely have a major hand in whatever crypto legislation clears Congress. If the Republican challenger doesn’t manage to knock Brown off, the crypto industry has cemented its antagonistic relationship with Brown as he keeps walking the Senate halls — a possibility that has some in crypto lobbying circles nervous.

However, this chess is definitely three-dimensional. Because the Senate is statistically more likely to swing into Republican hands in this cycle, the committee chair may be Senator Tim Scott, a Republican from South Carolina. And he’s recently come out as super excited about crypto. So, the industry might be able to clear a Senate bill without Brown’s support if the crypto industry fails to get Moreno into that chamber.

PREAMBLE

The U.S. crypto industry is waiting with bated breath for the results of the 2024 election.

Nearly $200 million from crypto-aligned political action committees has gone into supporting favored candidates, but some of the biggest races remain too close to guess who may win.

CoinDesk will cover the election results live over the coming day (or days, depending on how things go), with market commentary and up-to-the-minute alerts on major races we’re following – and how they may affect the crypto industry’s chances for legislation, regulatory updates and more across the coming months. The biggest race is obviously the U.S. presidential election, with Kamala Harris facing off against Donald Trump.

Polls begin closing on the east coast at 7:00 p.m. EST, but due to the tight nature of some of the races we’re following, we may not learn results immediately. Significant lawmakers running for reelection include Sherrod Brown, the Ohio Democrat who runs the Senate Banking Committee, Elizabeth Warren, Jon Tester and Debra Fischer.

The electoral map favors Republicans regaining the majority in the Senate. Similarly, Democrats are expected to regain the majority in the House of Representatives.

In the House, there’s an open question as to who will succeed retiring Congressman Patrick McHenry, who chairs the powerful House Financial Services Committee. A handful of Republican lawmakers are running to lead their party on the committee.

Crypto political action committees, including the Fairshake super PAC and its affiliated entities, Defend American Jobs and Protect Progress, have supported dozens of candidates across the House and Senate.

We’ll also be keeping an eye on the prediction markets, especially crypto-based betting site Polymarket. For the last few months, these markets have mostly favored Trump winning, although Polymarket has given him higher odds than U.S.-regulated exchange Kalshi and other platforms.

Right now, Trump is ahead by 23.4 points at 61.7% on Polymarket. An aggregate of eight prediction markets (plus Nate Silver’s forecast) built by trader Flip Pidot of American Civics Exchange gives Trump a more modest the lead with 16 points at 58.1%

Edited by Marc Hochstein and Benjamin Schiller.