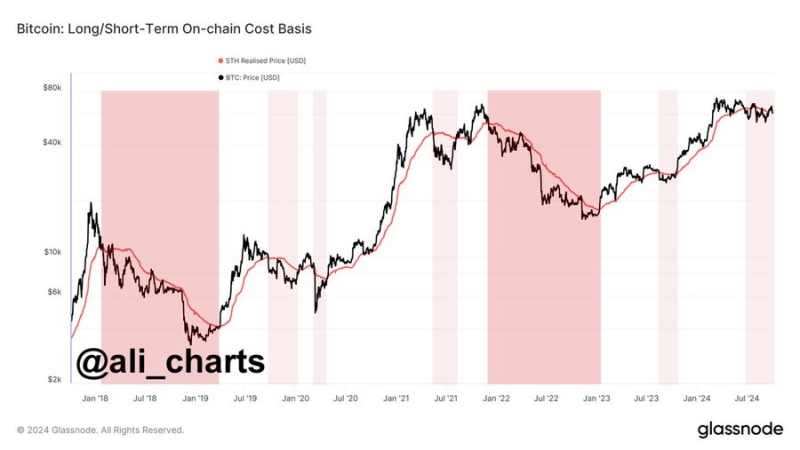

Bitcoin has been trading below short term holders’ realized price of $63,000, risking a sell-off.

Edited By: Jibin Mathew George

- BTC recovered slightly over the last 24 hours, gaining by 1.20%

- Bitcoin risks mass sells-off if it remains below short term holders’ realized price at $63,000

Over the past week, Bitcoin [BTC] has seen a sharp decline on the charts, dipping by 5. 61%.

The last 24 hours were different though, with the same adhering to the cryptocurrency’s generally bullish trend over the last few weeks. In fact, at the time of writing, BTC was trading at $62,099 following a 1.2% hike.

Despite this uptick, however, key stakeholders in the crypto market are worried. Especially over short-term holders’ realized price. One of those voicing their concerns is the popular crypto analyst Ali Martinez. In fact, he predicted a potential sell-off by short-term holders if BTC does not reclaim its $63,000 levels.

What does market sentiment say?

In his analysis, Martinez posited that if Bitcoin continues to trade below short-term holders’ realized price, the market will see greater selling pressure.

According to this analysis, BTC has traded below this level since 22 June 2024. Thus, if the price remains below this level, these holders who have held BTC for less than 155 days will sell to avoid further losses which will result in a cascading sell-off.

Therefore, the market must maintain this level around $63,000 to determine the next outcome.

In context, as long as BTC remains below its realized price for short-term holders, the likelihood of more selling pressure builds. If more short-term holders panic and sell, it could drive the prices lower, potentially triggering massive liquidations from leveraged positions, thus exacerbating the downtrend.

Simply put, Bitcoin has to reclaim $63,000. This will incentivize short-term holders to hold on to their BTC, anticipating further upside.

What do the charts say?

Notably, the analysis provided by Martinez also shared a worrying market outcome. However, it’s essential to determine what other market fundamentals suggest.

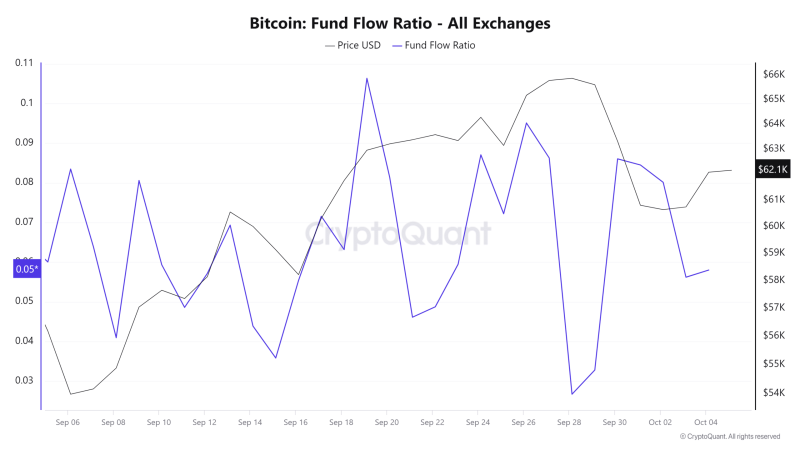

The first indicator to consider is Bitcoin’s Fund Flow ratio, with the same declining since 30 September. The fund flow ratio dipped from 0.08 to 0.05, signaling that fewer BTC is being transferred into exchanges.

This means that investors are moving their assets into private wallets, rather than selling. This often alluded to a more bullish sentiment as holders are not liquidating their positions in the short term.

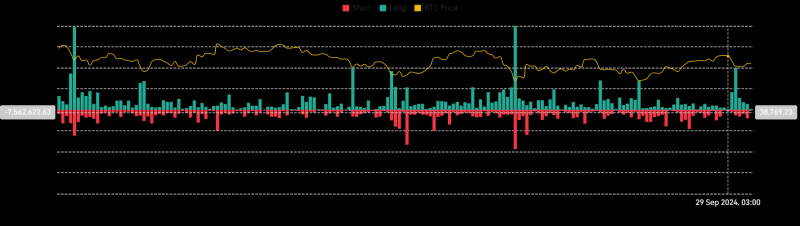

Additionally, since October started, liquidations for long positions declined from $123 million to $2.47 million at press time.

Such a reduction implies that many investors are anticipating the price to rise. Thus, they are paying a premium to hold, even during market downturns.

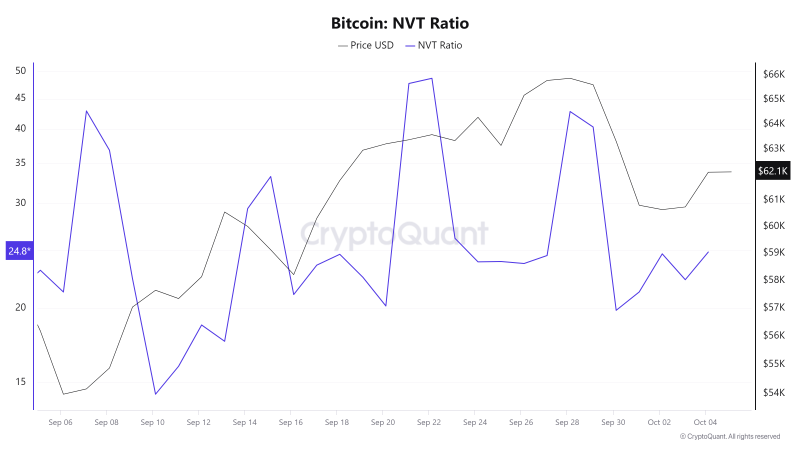

Equally, Bitcoin’s NVT ratio declined from 42.8 to 24.8 over the past week. Simply put, BTC may be currently undervalued, relative to its network activity. What this means is that the market has not yet caught up with the rising activity.

In conclusion, the prevailing market conditions could set BTC for further gains on price charts.