Here’s how DOGE can perform over the next few days, based on technical indicators.

Edited By: Saman Waris

- DOGE could hit $0.088 if bulls continued to buy.

- Longs should watch out for the rising volatility before opening a position.

According to Whale Alert, Dogecoin [DOGE] worth $7.90 million was transferred from an unknown address to Robinhood, an investment platform and crypto trading exchange.

So, it is possible that the party involved in the transaction planned to sell off the coins.

If this is the case, it could lead to a further decline in Dogecoin’s price. At press time, DOGE changed hands at$0.08, representing a 13.99% decrease in the 30 days.

A few days back, AMBCrypto had reported how DOGE pumped due to the speculation that the cryptocurrency would be involved in Elon Musk’s plans for XPayments.

However, it did not take long for the price rise to $0.09 to fizzle out. AMBCrypto also checked if the decline had affected some other metrics.

Activity on the network drops

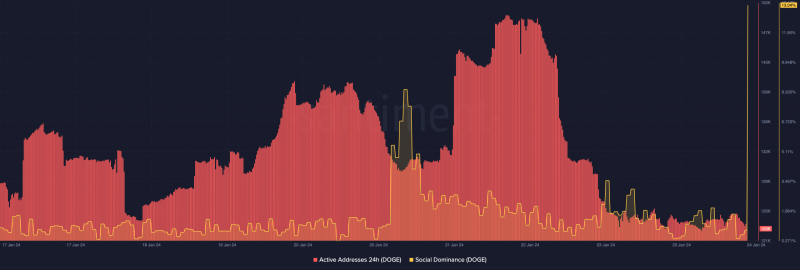

On-chain data from Santiment showed that the 24-hour active addresses jumped to 149,170 on the 22nd of January. At press time, the same metric had fallen to 123,000.

Active addresses can either be a bullish or bearish indicator. This is because it shows the number of distinct addresses speculating around a cryptocurrency.

When it jumps like it did on the 22nd, it means many market participants are interacting with the coin.

However, the recent decline suggests that crowd interaction has reduced, and players were no longer as bullish as they were a few days ago.

While the active addresses dropped, Dogecoin’s Social Dominance skyrocketed. Social Dominance helps to gauge the market sentiment by looking at the rate of discussions online.

So, the increase displayed above suggested that there were many conversations involving DOGE.

However, the spike in Social Dominance might not be great news for DOGE’s price. Historically, a jump like this leads DOGE downwards.

So, it is possible that the price could drop from $0.08 in the short term. But if the broader market recovers before that time, DOGE might sustain the level or even trade higher.

Rising volatility suggests vigilance

A look at Dogecoin’s technical aspect showed the Bollinger Bands (BB) had expanded. When this occurs, it means volatility is high and there could be significant price fluctuations.

From the look of things, the high Social Dominance might not stop DOGE’s run. This was because the BB showed that the price could hit $0.088 if the bulls continued to buy the coin.

Though the Chaikin Money Flow (CMF) was -0.03, its direction indicated that it could soon climb into positive territory. Should the CMF close above the midpoint, then DOGE’s bullish trend could be confirmed.

However, if the CMF stays in the negative region, Dogecoin might continue trading sideways.

How much are 1,10,100 DOGEs worth today?

For now, traders might need to be careful about opening a long position. This was because of the Supertrend as it was above Dogecoin’s price.

If the Supertrend falls below DOGE, then that could be a buy signal, something that longs would potentially profit from.