The recent recovery in Ethereum coin price has hit a stumbling block around the $1666 mark. A quick glance at the daily charts reveals that this surge met significant resistance from a declining trendline, causing a swift price reversal. This trendline, instrumental in guiding prevailing correction over the past two months, suggests that a further downtrend might be on the horizon.

Also Read: What’s ERC-7512? A New Standard Proposed By Ethereum Developers

Will Correction Trend Prolong Below $1500

- The overhead supply at the resistance trendline set an 8% fall ahead

- The $1460 support aligned with the long-coming support trendline creates a strong demand zone

- The intraday trading volume in Ether is $4.22 Billion, indicating a 4.2% gain.

Source- Tradingview

On September 19th, the ETH price experienced its third price rejection from this same declining trendline. This reversal showed the formation of consecutive lower highs on the daily chart reflecting a strong indicator that the bearish sentiment still prevails.

In just the span of the past three days, the second-largest cryptocurrency has descended by 3.8%, currently trading at $1596. If this bearish trajectory continues unchecked, we could see Ethereum dip another 4%, potentially targeting the $1460 support level.

For those traders looking for a bullish entry point, it would be prudent to await a confirmed breakout above this pesky resistance trendline. Such a bullish move could pave the way for a renewed uptrend in ETH price.

1 ETH to USD = $1595.628 0.13% (24h) Buy / Sell

Buy Crypto on an easy to use platform

Invest in leading cryptocurrencies such as Bitcoin, Ethereum, Cardano and more…

ETH

USD

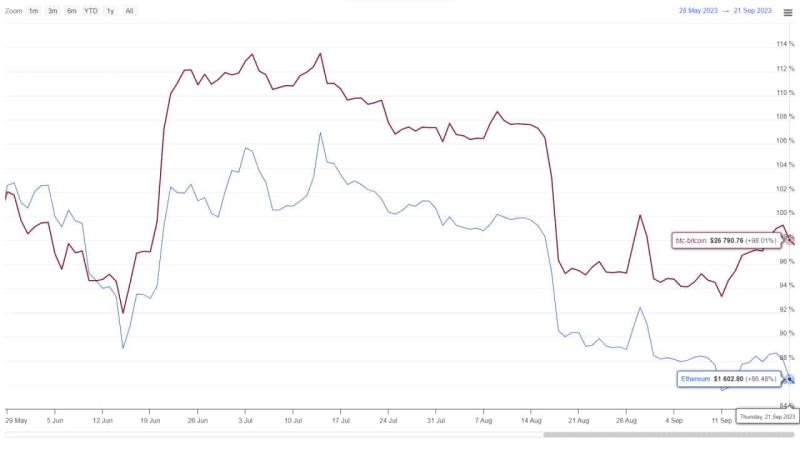

ETH vs BTC Performance

Source: Coingape| Ethereum Vs Bitcoin Price

Comparing the ETH price movements to the Bitcoin price over the last quarter, it’s evident that the Ethereum coin has been lagging. Since mid-August, this altcoin’s descent has been steeper, and its attempts at recovery have been tepid at best. This comparative underperformance underscores the cautious approach traders might want to adopt when considering buying Ether in the near term.

- Exponential Moving Average: The Ethereum price failure to sustain above the 20-EMA slope reflects weakness in bullish momentum.

- Moving Average Convergence Divergence: The nearing bearish crossover between the MACD(blue) and the signal(orange) line might intensify selling pressure in the market.