Ethereum faces mixed signals with whale accumulation rising despite a 22% price drop. Will it rebound?

Edited By: Jacob Thomas

- Ethereum dropped 22% despite Eric Trump’s endorsement and increasing whale activity.

- Whale buying spiked as large investors positioned themselves in the face of a downtrend.

On the 4th of February 2025, Eric Trump made waves by endorsing Ethereum’s [ETH] on his X (formerly Twitter) account, urging followers to buy Ethereum.

However, since then, Ethereum’s price has dropped massively, by 22%. Despite this decline, a surge in whale activity has been recorded, with 110,000 ETH being accumulated in just 72 hours.

Amid mixed signals, one does wonder: Are large investors positioning themselves for a rebound, or is the market still on a downward trajectory?

Eric Trump’s endorsement and subsequent decline

The initial reaction to Trump’s endorsement was followed by a brief price surge, but the rally quickly fizzled out. Since then, Ethereum’s price has dropped 22%, leading to questions about the lasting impact of his endorsement.

Several factors have contributed to the price decline. A significant $1.5 billion hack of the Bybit exchange on the 25th of February undermined investor confidence, triggering a broader market selloff.

Additionally, fading euphoria following President Donald Trump’s election, coupled with unmet expectations for a pro-crypto regulatory framework, has dampened market sentiment.

Global economic uncertainties have also pressured Ethereum’s price downward.

Whale accumulation: A vote of confidence or a tactical play?

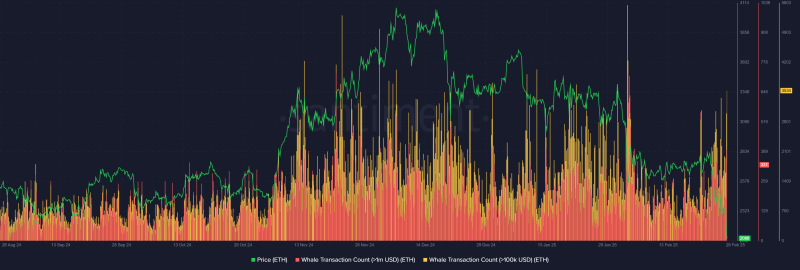

Despite Ethereum’s 22% drop, whale activity has surged, with 110,000 ETH accumulated in just 72 hours. Santiment data highlights a sharp increase in whale transactions.

This suggests large investors may be positioning themselves for a rebound or capitalizing on discounted prices.

Historically, similar accumulation phases have been followed by strong recoveries, but not always.

For instance, heavy whale activity in late December 2024 coincided with ETH’s peak, and mid-January saw a similar accumulation, which aligned with a brief bounce.

If ETH holds the $2,100–$2,135 range, this could reinforce bullish sentiment. However, a sustained break below this level could suggest that whales are securing liquidity before a deeper correction.

Ethereum: Whale confidence vs. bearish momentum

Ethereum’s oversold RSI at 38.90 and a deepening MACD bearish crossover indicate a prolonged downtrend. The 50-day SMA at $2,929 remains significantly above Ethereum’s current price of $2,109, reinforcing bearish pressure.

If whales are buying to front-run a recovery, reclaiming the $2,200–$2,300 range could validate a short-term bounce.

Retail investors should remain cautious. If ETH fails to hold key support, the next major demand zone lies around $1,900–$2,000.

Whale buying isn’t always a definitive bullish signal, especially in a market-wide downturn. Retail investors should watch for confirmation of a trend reversal before following whale sentiment.