Dogecoin has experienced significant accumulation recently, with large holders adding over 2 billion DOGE tokens valued at $200 million.

Edited By: Ann Maria Shibu

- Dogecoin has seen significant declines in the last two weeks.

- DOGE has slipped slightly into a bear trend due to the declines.

Despite its lacklustre price performance, Dogecoin [DOGE], the largest memecoin by market capitalization, has experienced significant accumulation in recent weeks.

The uptick in accumulation, however, has yet to translate into any meaningful price rebound, as DOGE continues to struggle after recent declines.

Large Dogecoin holders playing the long game

According to CoinMarketCap, Dogecoin has lost over 8% of its value in the last seven days, bringing its market capitalization down to around $15.8 billion. The decline has eroded some of its market value, but large holders remain undeterred.

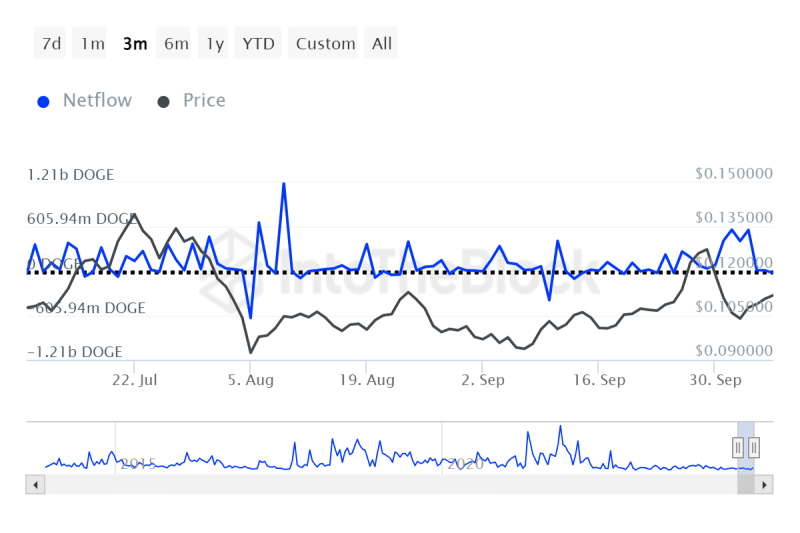

Data from IntoTheBlock revealed that large holders accumulated over 2 billion DOGE tokens during the past week, marking the largest accumulation event since January.

Based on current prices, this accumulation is valued at approximately $200 million. This suggests that significant Dogecoin investors are taking a long-term approach, betting on the memecoin’s eventual recovery.

Recent uptrends fail to boost Dogecoin

Despite the accumulation, Dogecoin’s price has continued to decline. An analysis of its price chart shows that Dogecoin experienced an over 8% decline on the last day of the previous month, followed by a 6% decline at the start of the current month.

The downtrend continued with an additional 2% drop on the next day.

Although Dogecoin saw some consecutive uptrends recently, they were insufficient to reclaim the price levels it had lost. By the end of the most recent trading session, Dogecoin had fallen by 2.8%, trading around $0.108. As of this writing, it is trading slightly lower at $0.107, but it has found support at the 50-day moving average, holding strong around $0.105.

Over 50% of DOGE holders remain in profit

Despite the ongoing price declines, many Dogecoin holders remain in profit. Analysis of the In/Out of the Money chart from IntoTheBlock shows that over 69% of holders, or approximately 244,000 addresses, are still “In the Money” around the current price.

Further analysis of the Global In/Out of the Money chart shows that more than 72% of Dogecoin holders are currently profitable, reflecting strong investor sentiment despite recent market challenges.

Is your portfolio green? Check out the Dogecoin Profit Calculator

While Dogecoin has seen record accumulation from large holders, the memecoin’s price continues to face challenges.

However, with over 50% of its holders still in profit and strong support around $0.105, Dogecoin’s long-term prospects may still hold promise.