These on-chain analysts opined that an opportunity lies in the ETH market from a technical perspective.

- Although ETH displayed signs of weakness, it had the potential to surge.

- The altcoin’s volatility was low as the price continued to drop.

For some time, Ethereum [ETH] has been experiencing a relatively subdued period in the market, with concerns arising about its price action. However, analysts are cautioning against interpreting this phase as a weakness in the altcoin.

Some of those backing ETH to thrive include Glassnode co-founders Jan Hapell and Yann Allemann. The duo, who operate on Twitter under the “Negentropic” username, noted that Bitcoin [BTC] might shine going forward.

The calm before ETH storms

The analysts argued that ETH’s apparent calmness should not be underestimated, as there could be a” golden mid-term opportunity.” Hapell and Allemann, in their tweet, also shared an image of the ETH/USD chart, indicating that the altcoin could be set for a breakout.

Over the last seven days, ETH has been hovering around $1,835 and has been unable to hit $1,900 within the said timeframe. But do metrics agree that an ETH breakout is on the horizon?

Well, from Glassnode’s data, ETH’s seller exhaustion constant was down to $0.097. The seller exhaustion constant is the product of the 30-day price volatility and the coin supply in profit.

Originally created by ARK Invest and David Puell, the metric also checks for capitulation and bottoms. So the drop indicates low volatility and high losses. Thus, ETH could be close to its lowest value in the current market cycle.

Is ETH at a fair price?

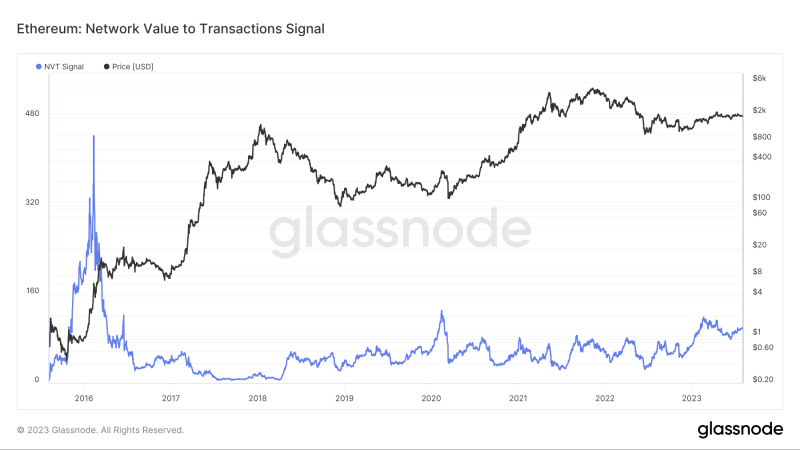

Additionally, the Network Value to Transaction (NVT) signal rose mildly after a recent fall to 82.92. As a modified version of the NVT Ratio, the NVT signal checks if a blockchain network is overvalued or not by using the 90-day Moving Average (MA).

If the metric jumps extremely high, it means that the asset is overvalued. But ETH’s NVT increase was not exactly significant. So, the coin can be said to be at a fair value.

As per the price action, the ETH/USD 4-hour chart showed that the altcoin held support at $1,831. Despite numerous attempts to push the price upwards, selling pressure has ensured that ETH gets rejected at $1,857.

The Exponential Moving Average (EMA) also gave an insight into what to expect from ETH in the short term. At press time, the 20 EMA (blue) was below the 50 EMA (yellow).

If the 20 EMA is above the 50 EMA, the trend is bullish. But if the 50 EMA is above 20 EMA, the trend is bearish. Therefore, the odds are on ETH to decrease before any run up the charts.