Contents

DODO is an algorithm-based liquidity provider platform that deploys a unique Proactive Market Maker (PMM) mechanism to enhance price stability. The DODO token has attracted investor attention this week after scoring double-digit gains within an eventful 72 hours.

Why is DODO Price Rallying?

On Monday, Aug.7, cryptocurrency exchange giant Binance announced that it would launch a DODO/USDT trading pair for perpetual contracts on its CEX trading platform.

Perpetual Contracts are a specialized trading product offering that allows crypto investors to take outsized positions speculating on the future price of an asset.

On-chain data shows the DODO network activity instantly spiked to a 7-month peak within 24 hours of the Binance announcement. This laid the groundwork for the 60% DODO price rally that followed.

User Activity Remains High Despite Recent Price Wobble

After closing Tuesday at $0.13, DODO has gradually wobbled toward $0.11, sparking fears of a network-wide sell-off. However, on-chain data suggest that many retail network participants on DODO remain confident of a prolonged rally.

Following the Binance announcement, DODO Daily Active Addresses (DAA) spiked 290% from 54 active participants on August 6 to 209 at the close of August 7.

But, notably, even as the price corrected by over 25% from its peak of $0.178 on August 8, the retail participants did not waiver. Instead, the DAA increased by another 110% to reach 439 active addresses.

DODO Price Rally Weakens | Daily Active Addresses, Feb – Aug 2023? Source: Santiment

The Daily Active Addresses metric evaluates user activity on a blockchain network by aggregating the daily number of unique wallet addresses carrying out transactions

Multiple spikes in DAA are a bullish signal indicating growing interest among mass-market investors.

Partly due to this increase in retail demand, DODO price has avoided dipping below the $0.11 support level so far.

Read More: Best Crypto Sign-Up Bonuses in 2023

Exchange Order Books Show that DODO Traders are Preparing to Sell

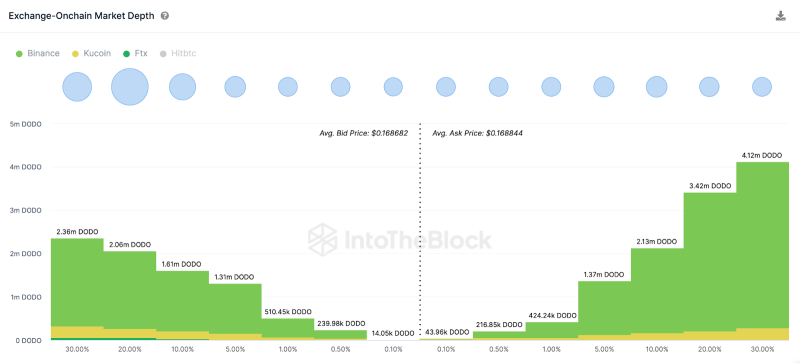

Interestingly, the aggregate order books of exchanges reveal that some DODO traders want to book profits. The Exchange On-chain Market Depth chart shows the volume of orders that crypto traders have placed for an asset across various exchanges.

Cumulatively, the bears have prepared active orders to sell 11.7 million DODO tokens around the current prices. This far outweighs the 8.1 million active purchase orders from investors looking to ape in on the DODO price rally.

DODO Price Rally Weakens | Exchange On-chain Market Depth, Aug 2023. Source: IntoTheBlock

When an asset’s active sell-orders outweigh market demand, it signals that it could be on the verge of a price correction. As things stand, DODO sell-orders have exceeded market demand by 3.6 million.

If the momentum turns bearish, DODO traders could begin to lower prices drastically in a race to get their orders filled quickly.

Unless the retail network activity evolves into greater market demand, the DODO price rally may fizzle out in the coming days.

Read More: Best Upcoming Airdrops in 2023

DODO Price Prediction: Potential Reversal Below $0.10

Drawing inferences from the on-chain indicators analyzed above, the DODO price will likely edge closer to $0.10 in the coming days. However, the bulls will offer initial support around the $0.11 range.

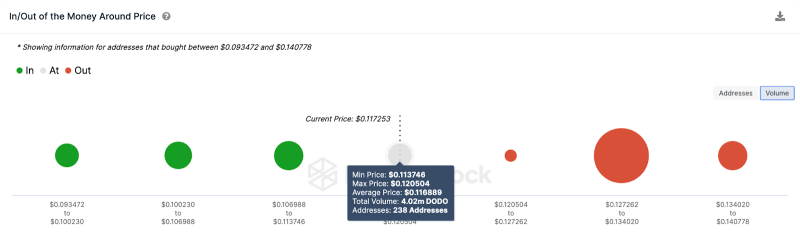

The In/Out of Money Around Price (IOMAP) data, which shows the purchase price distribution of current holders, also lends credence to this prediction.

As seen in the chart below, 238 addresses had bought 4.02 million DODO at the minimum price of $0.11.

But, if the momentum turns bearish, the DODO price rally could fizzle and drop to $0.10.

DODO Price Prediction | IOMAP data, Aug 2023. Source: IntoTheBlock

But in contrast, the bullish retail investors could seize control if DODO price rebounds above $0.16 again. But as depicted above, 313 holders that bought 44 million DODO tokens at the average price of $0.13 could trigger a pullback

However, if that resistance gives way, DODO could successfully reclaim $0.16.

Read More: 9 Best AI Crypto Trading Bots to Maximize Your Profits