Solana ETF is moving forward after VanEck and 21shares filed for the listing with CBOE.

Edited By: Ann Maria Shibu

- CBOE receives request for Solana based ETFs from VanEck and 21shares.

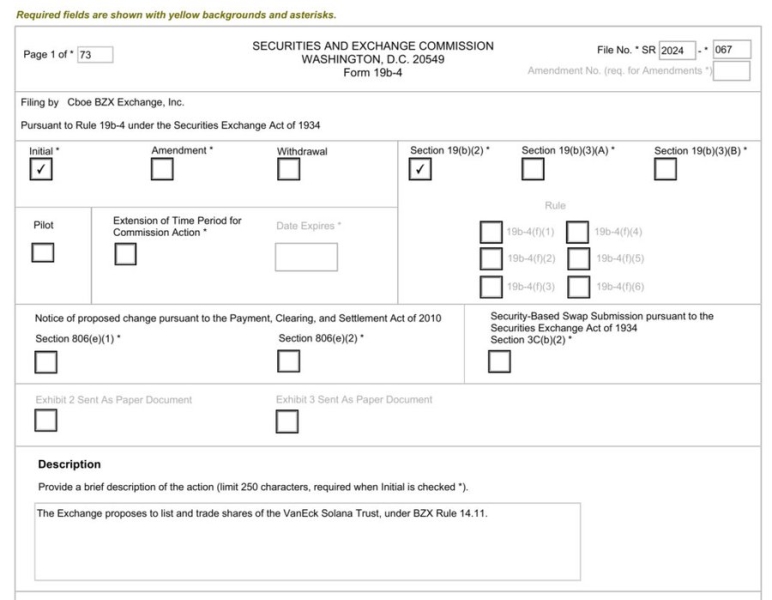

- CBOE submitted 19b-4 filing with SEC for Solana ETFs.

After submitting S-1 last month, 21 shares and VanEck are set to list their products with CBOE. According to reports, CBOE Chicago Board Options Exchange has requested the SEC to allow VanEck and 21Shares to introduce a Solana [SOL] ETF.

Mathew Sigel, Head of digital assets research at VanEck, reported the developments on X. He tweeted,

“We at @vaneck_us are pleased to announce that @CBOE. I just filed our 19b-4 to list and trade shares of the FIRST Solana exchange-traded fund in the US! We look forward to engaging with the SEC during the review period.”

The CBOE submitted the 19b-4 filing with the securities and exchange commission (SEC) requesting Solana-based ETF. If the SEC acknowledges the filing, the commission will have 240 days to accept or deny.

Rob Marrocco, the head of CBOE global markets, explained that since acquiring SEC approval for BTC and ETH, SOL being the third most traded crypto, the growing investor interests warrant ETFs.

Currently, CBOE also lists other ETFs for BTC and ETH. Based on their official reports, they have listed 10 of the current BTC ETFs .

Equally, they are listing five ETFs for ETH when officially approved by the SEC. Ether ETFs are expected to receive SEC approval this week.

Impacts of SOL ETFs on crypto markets

SOL ETF approval will impact the crypto community and Solana investors.

Firstly, SOL ETF will attract institutional investors who will increase capital and financial flow into the Solana market.

The entrance of institutional investors will play a critical role in driving prices up and higher liquidity and pushing SOL competitiveness to the same level as BTC.

For instance, after BTC ETF approval this year, the prices went to ATH of $73k, and despite the decline, every metric indicates a $100k level by the end of the year.

Secondly, the approval of SOL ETFs signals traditional financial markets’ acceptance of digital assets, thus increasing adoption and integration.

Read Solana’s [SOL] Price Prediction 2024-25

Solana community is optimistic about the ETF, seeing it as a major progress that could open profitability while creating a path for other cryptocurrencies’ ETFs.

Thus, a SOL ETF will help legitimize the altcoin while bolstering investments. However, increased engagement with regulatory authorities will increase scrutiny, affecting the core aim of blockchain, which is decentralization.