On Aug. 8, Ark Invest CEO Cathie Wood spoke to Bloomberg about the current status of pending ETF applications.

Bitcoin ETF Race Heats Up

Ark’s application for a spot Bitcoin ETF was published in the Federal Register on May 15.

The SEC designated Aug. 13 as ‘The date by which the Commission shall either approve or disapprove or institute proceedings to determine whether to disapprove, the proposed rule change.’

Wood, whose firm filed earlier than BlackRock did for an ETF, said:

“August 13 will come and go and I think the SEC if it is going to approve a Bitcoin ETF, will approve more than one at once,”

She added that most of the products are essentially the same, so it will come down to which companies have marketed them better. Wood said that Ark’s research was deep, and they have been doing it since 2015, when it first gained exposure to the asset through Grayscale.

When asked whether the firm would sell its GBTC holdings and buy spot exposure for its own Next Generation Internet fund, she was very evasive and said, “I cannot talk about it.”

Additionally, ETF analyst at Bloomberg Intelligence, James Seyffart, said:

“I think Cathie is seeing and hearing the same things we are,”

In addition to Ark, eight other companies have also filed for a spot BTC product. These include BlackRock, Bitwise, VanEck, Invesco, and WisdomTree, which have also filed applications for a spot Bitcoin ETF.

Moreover, Grayscale also said that the “first mover” advantage would be tremendous in a recent letter.

″The SEC’s actions related to Bitcoin ETFs should be made in a fair and orderly manner. As a disclosure-based regulator, the SEC should not pick winners and losers.”

The SEC has yet to approve a spot BTC product citing market manipulation and fraud. However, it has approved futures-based ETFs, which are backed by futures contracts instead of the asset itself.

Ethereum ETFs in the Pipeline

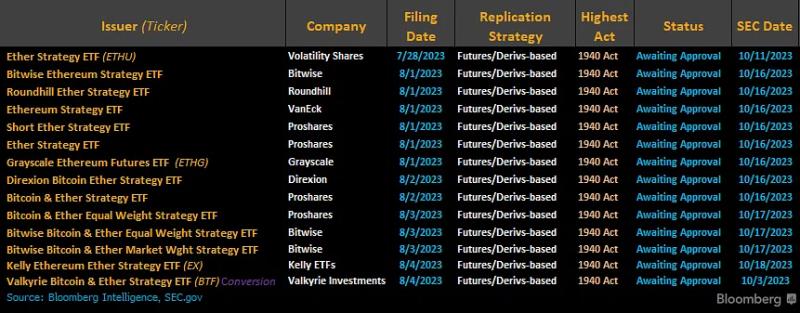

There has also been a rush of Ethereum ETFs submitted, but industry experts said they may be withdrawn again.

On Aug. 5, Valkyrie filed a request to change the investment strategy of its Bitcoin Futures ETF (BTF) to include Ethereum Futures.

There are currently 14 Ethereum and mixed exchange-traded products in the approval queue, reported Seyffart over the weekend.

Ethereum and mixed asset ETF applications. Source: X/@Jseff

The crypto ETF race is heating up, but the regulatory oppression of the industry in the US doesn’t bode well at the moment.