On August 8, the Chainlink team announced a much-heralded partnership with Coinbase. It would see its price feeds integrated into the latter’s layer-2 network, Base. On-chain data analysis explores how this could potentially impact LINK price action in the coming weeks.

Coinbase Partnership Has Convinced Chainlink Whales to Start Buying Again

A price-savvy cluster of Chainlink whales had booked profits during the first week in August. But interestingly, following the Coinbase partnership announcement on August 8, they instantly started buying again.

The chart below illustrates the trading activity of crypto whales holding balances of 100,000 to 1 million LINK over the past two weeks. During the first week of August, they had depleted their holdings from 121.9 million to 116.74 million tokens.

However, they flipped the script on August 8, buying up a whopping 1.7 million LINK tokens in 3 trading days leading up to August 11.

Coinbase Partnership Could Push Chainlink (LINK) Price | Whales Wallet Balance Aug 2023, Source: Santiment

Tracking real-time changes in Whale Wallet Balances provides objective insights into their current trading sentiment. With the LINK price currently hovering around $7.56, the 1.7 million tokens the whales recently purchased are worth approximately $12.8 million.

Such a large volume of whale inflows within three days is a bullish signal. But additionally, considering the timing, it suggests that the August 8 Coinbase partnership announcement might have rekindled the whales’ confidence.

If strategic retail investors also ape into the bullish momentum, the LINK price could gain as much as 20% to reclaim $9.

Chainlink On-Chain Activity Has Received a Major Boost As Well

Furthermore, Chainlink has also witnessed a significant increase in network activity since its proprietary price feeds were integrated into the Base network on August 8.

According to Santiment, Chainlink had attracted only 1,666 active addresses on August 6. But by the cost of August 10, it had skyrocketed by 82% to reach 3,033 active wallet addresses.

Coinbase Partnership Could Push Chainlink (LINK) Price | Daily Active Addresses, Aug 2023, Source: Santiment

The Daily Active Addresses (DAA) metric shows the aggregate number of network participants performing economic activity on a blockchain network. As seen above, it signals growing demand and transaction activity across the network when it rises astronomically.

This spike in network activity coincided with the announcement of Chainlink’s partnership with Coinbase earlier this week.

From the on-chain indicators highlighted above, it could be inferred that there is a growing network demand from retail market participants. Combined with the whales’ buying pressure, it could give LINK a shot in the arm to claim up to 20% price gains in the coming weeks.

LINK Price Prediction: Clear Road to $10?

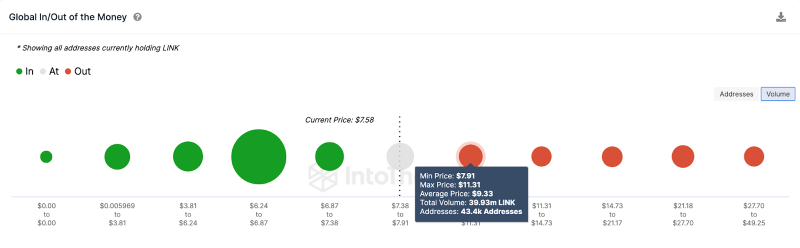

The Global In/Out of Money (IOMAP) data depicts the key support and resistance levels by analyzing all current holders’ critical purchase price distribution. It shows that the $9 territory poses the strongest resistance that could prevent LINK from hitting the $10 price target.

As depicted below, 43,400 addresses had bought just under 40 million LINK tokens at the average price of $9.33. If they exit their positions, they could trigger a pullback.

But if the Chainlink partnership with Coinbase keeps the whales buying as predicted, the LINK price could score more than 20% gains to reclaim $10.

Chainlink Link (LINK) Price Prediction | GIOM data, August 2023. Source: IntoTheBlock

Still, the bears could invalidate the optimistic prediction if the LINK price falls below $7 again. But first, the 60,000 addresses that bought 82 million Chainlink tokens at the average price of $7.10 could offer initial support

Nevertheless, if that support level caves in, LINK could retest sink toward $6.50 for the first time in over a month.

Read More: 9 Best AI Crypto Trading Bots to Maximize Your Profits