Cardano hinted that the Mithril mainnet launch is around the corner. But ADA’s response to the update was not up to par.

- Mithril seeks to improve the speed and efficiency of nodes’ syncing times.

- ADA was down by more than 10% in the last seven days, and metrics were ambiguous.

As Cardano’s [ADA] much-awaited Mithril mainnet launch drew closer, the community started looking forward to the multiple changes and new features being brought by the protocol.

Input Output Global recently published a blog highlighting the meaning and importance of the upcoming update. Nonetheless, ADA’s response to Mithril’s upcoming launch did not look good, as its charts were painted red at press time.

Mithril's mainnet release is just around the corner.

Read this blog post to recap what #Mithril is, how it works, and how it helps with the fast bootstrapping of #Cardano nodes. ⤵️ https://t.co/TRknmLhq5q pic.twitter.com/4TJ6u35acG

— Input Output (@InputOutputHK) July 20, 2023

Cardano is awaiting a new update

Input Output Global’s tweet suggested that the Mithril launch date was coming closer. For the uninitiated, Mithril is a stake-based signature scheme and a protocol that improves the speed and efficiency of nodes’ syncing times.

In August 2022, Mithril’s proof of concept was made public. The team officially unveiled Mithril in December. The protocol boosts node syncing time, offers security, and empowers decentralized decision-making.

As per the official announcement, with Mithril, Cardano’s network will become more efficient, streamlined, and capable of supporting a wider range of applications and use cases. The first use case introduced with the first beta release on the mainnet uses Mithril to swiftly and effectively bootstrap a full Cardano node.

ADA’s reaction pales in comparison

Though the upcoming update looks optimistic for the blockchain, its native token price did not react accordingly. According to CoinMarketCap, ADA was down by more than 10% in the last seven days. At the time of writing, it was trading at $0.3127 with a market capitalization of over $10.9 billion.

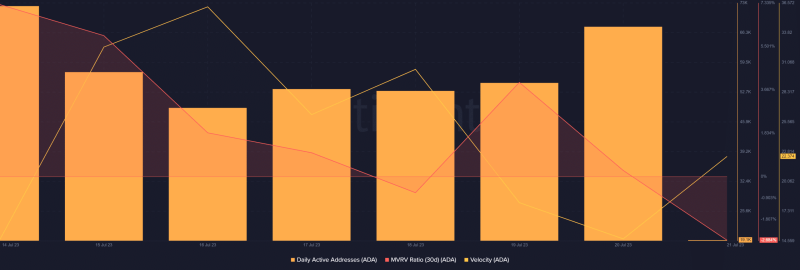

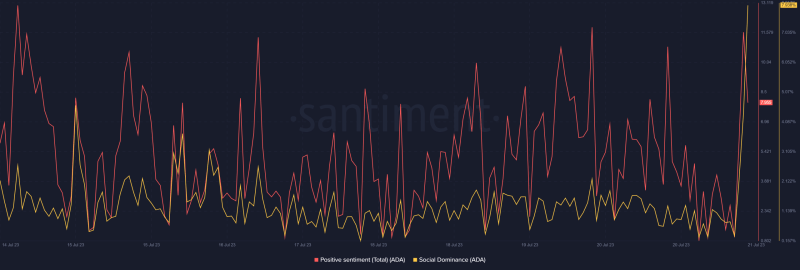

Investors’ willingness to trade ADA was also low as its 24-hour trading volume declined. Nonetheless. ADA remained a topic of discussion as its social dominance was high. The positive sentiment also spiked on 21 June, which was optimistic.

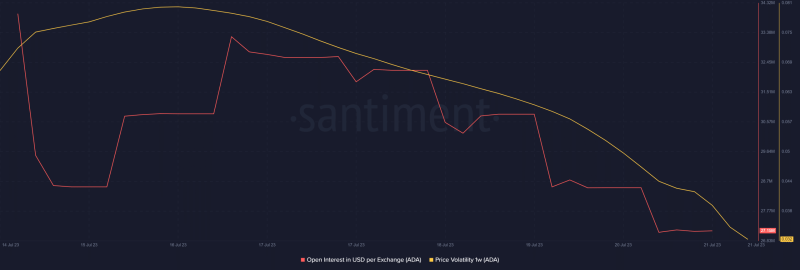

However, a few metrics suggested a trend reversal. For instance, Cardano’s 1-week price volatility dropped, decreasing the chances of a continued downtrend. Its Open Interest also declined, suggesting that the possibility of a trend reversal was high.

Not only that, but the blockchain’s daily active addresses also increased over the last week. This suggested a larger number of users on the network. However, ADA’s MVRV Ratio plummeted sharply. Its velocity also waned – a negative signal.