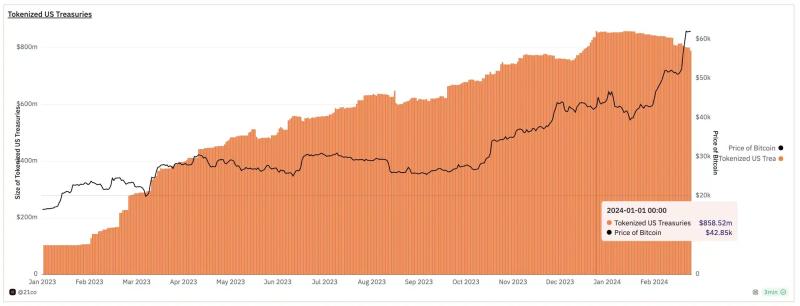

A negative correlation emerged between investments in tokenized treasuries and Bitcoin’s price.

Edited By: Saman Waris

- The growth curve of DeFi protocols providing exposure to U.S. treasuries has stagnated.

- These products were anticipated to remain cold in the coming months.

Tokenized U.S. treasuries were one of the biggest success stories in decentralized finance (DeFi) during last year’s bear market.

By issuing them as on-chain assets, DeFi users gained access to one of the safest and most reliable investment vehicles in the traditional market.

However, since the beginning of 2024, investors’ appetite for such projects has dipped considerably, with most getting drawn towards returns offered by riskier investments such as cryptocurrencies.

Bitcoin’s gain is tokenized treasuries’ pain

On-chain analyst Tom Wan drew attention to the negative correlation between investments in tokenized treasuries and the price of Bitcoin [BTC].

As the world’s largest cryptocurrency grew from $38k to $64k, the size of the on-chain treasury market shrank.

Moreover, the growth curve of protocols providing exposure to U.S. treasuries stagnated.

Ondo Finance and Mountain Protocol, two of the biggest names in the sector, saw monthly TVL drops of 0.1% and 0.26% respectively, AMBCrypto examined using DeFiLlama data.

Not looking too optimistic?

A weak macroeconomic climate and a hawkish U.S. Federal Reserve spurred attractive yields on U.S. government debt last year.

Their subsequent tokenization enabled Web3 users to enjoy these assured returns as well. This was the time when the crypto market had stagnated.

However, as the market heated up in recent months, many investors ditched the stable 5% yield in favor of double-digit, and even triple-digit returns.

Given broader expectations of the Fed cutting interest rates, tokenized treasuries were anticipated to remain cold in the coming months.

Tom Han, while advising the builders of these projects, said,

“In my opinion, U.S. Treasuries protocols should focus on adoption and integration instead of product expansion.”

He stated that though the idea of tokenization of equities and bonds sounds cool, the sector was vulnerable to regulatory risks.

He also suggested integrating these products into layer-1 and layer-2 networks to boost their adoption.