Selling pressure on Bitcoin is on the rise, hinting at a possible price correction.

Edited By: Ann Maria Shibu

- BTC was up by more than 5% in the last 24 hours.

- Metrics suggested that investors were selling BTC to earn profits.

Bitcoin [BTC] is on a gaining spree as its price is inching towards an all-time high. However, things might not be as picture-perfect as they look as key indicators flagged a sell signal. Does this mean that BTC investors might have to wait longer to see the coin reach a new ATH?

Bears are gearing up

According to CoinMarketCap, BTC was sitting comfortably above the $66k mark as its value surged by more than 5% in the last 24 hours. At the time of writing, BTC was trading at $66,769.99 with a market capitalization of over $1.3 trillion.

Meanwhile, Ali, a popular crypto analyst, revealed a sell signal. As per the tweet, the TD Sequential indicator showed a sell signal for BTC in the 4-hour chart. Since the 15th of February, every time this indicator suggested selling, the price of BTC dropped by 1.5% to 4.7%.

Apart from that, BTC’s fear and greed index registered a reading of 90, indicating high “greed” in the market. Whenever the metric reaches that level, it hints that the chances of a price correction are high.

Selling pressure is rising

Since these metrics looked bearish, AMBCrypto took a look at CryptoQuant’s data to see whether investors had already started to sell BTC.

As per our analysis, BTC’s net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

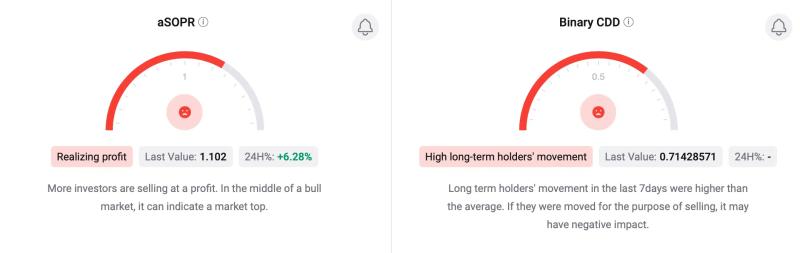

The king of cryptos’ binary CDD was red, meaning that long-term holders’ movements in the last seven days were higher than average. If they were moved for the purpose of selling, it may have a negative impact.

Additionally, its aSORP also turned red. This suggested that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top.

To add to the problem, Bitcoin’s Relative Strength Index (RSI) was in the overbought zone, which might exert selling pressure on the coin.

The Chaikin Money Flow (CMF) also registered a downtick, suggesting that the chances of a price correction are high. Nonetheless, the MACD remained in buyers’ favor as it displayed a bullish advantage in the market.