Bitcoin’s Incoming Phase Could See It Hit $45,000

In a post shared on their X (formerly Twitter) platform, crypto analyst CryptoCon shared his prediction on Bitcoin’s future trajectory. The analyst mentioned that Bitcoin was currently at the “Mid-Cycle phase 4,” which happens to be the period where the crypto token is heading closer to the “Cycle Mid-Top,” which currently positions Bitcoin to rise above $45,000.

CryptoCon’s prediction seems to be made based on the Fibonacci trading strategy, as evident in the accompanying chart, which he shared in his post. The chart breaks down Bitcoin’s historical price data into four cycles, namely: Cycle 1 (2010-2014), Cycle 2 (2015-2018), Cycle 3 (2019-2022), and Cycle 4 (2023-2026).

The Phases In These Cycles

These cycles are further divided into five phases, which CryptoCon seemed to focus more on. These phases include Phase 1 (Cycle Lows), Phase 2 (Transition from Cycle Lows), Phase 3 (First Move out of the Lows), Phase 4 (Transition to Cycle Mid-Top), and Phase 5 ( Cycle Mid-Top).

CryptoCon noted that Bitcoin’s price usually hits phase 5 quickly once phase 2 is over (about two months after, according to the analyst), and if that is the case once again, then $45,000 could be soon. If that doesn’t happen, he foresees that Bitcoin could face resistance at the top of the transition, where it is currently priced at $36,368.

As to when all this could happen, he noted that October represents the first month after phase 2 ended. Therefore, the market could see the mid-top phase could happen as soon as November when Bitcoin will likely hit and rise above $45,000.

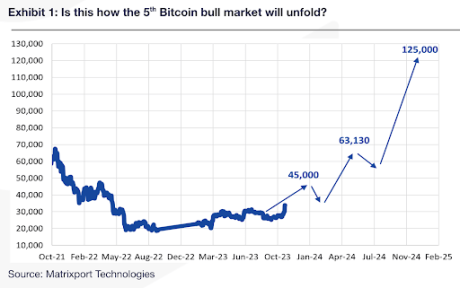

Interestingly, CryptoCon’s prediction coincides with that of the crypto platform Matrixport, which estimates that Bitcoin could hit $45,000 between November this year and April 2024. In their report, Matrixport goes on to make a bolder claim that Bitcoin could hit $125,000 by December 2024.

Bitcoin Halving Or Institutional Adoption?

Different crypto analysts have continued to make predictions about Bitcoin’s future trajectory even as the Bitcoin Halving draws nearer. Some of these analysts have credited the event as the catalyst that will spark the massive surge in Bitcoin’s price. Others believe that the launch of a Spot Bitcoin ETF alongside institutional adoption is what will make Bitcoin hit new highs.

Meanwhile, some contemplate that the market may already be priced in as to any impending approval of a Spot Bitcoin ETF, as this is a classic case of “buy the rumor, sell the news.” If that is the case, many predict that we could see a decline when the ETFs launch due to massive sell-offs from traders and investors looking to realize their gains.

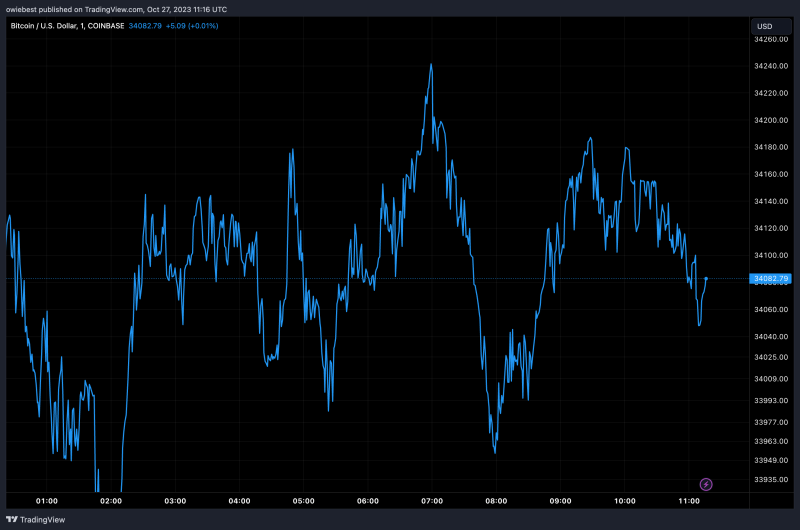

Featured image from Shutterstock, chart from Tradingview.com