Bitcoin and crypto are in line for a classic breakout should multiple time-tested patterns continue, says analyst Cole Garner.

Bitcoin (BTC) is preparing a “full bull” BTC price phase in classic style, market cyclist Cole Garner believes.

In social media analysis on Aug. 6, the popular on-chain analyst said that major upside awaits both Bitcoin and the broader crypto market.

Bitcoin “bull market’s backbone” strengthening

BTC price action continues to stagnate, but those looking further into the future are convinced that this cycle is just like any other.

For Garner, activity among the largest-volume cohort of Bitcoin investors — the whales — is one such cause for optimism.

“Whale accumulation trends are a bull market’s backbone,” he summarized.

Garner linked to findings from analytics team Jarvis Labs, which in response to a Cointelegraph article in June, flagged an ongoing “multi-month buying frenzy.”

It is not just whales; smaller investors, known as fish, have likewise been increasing their BTC exposure.

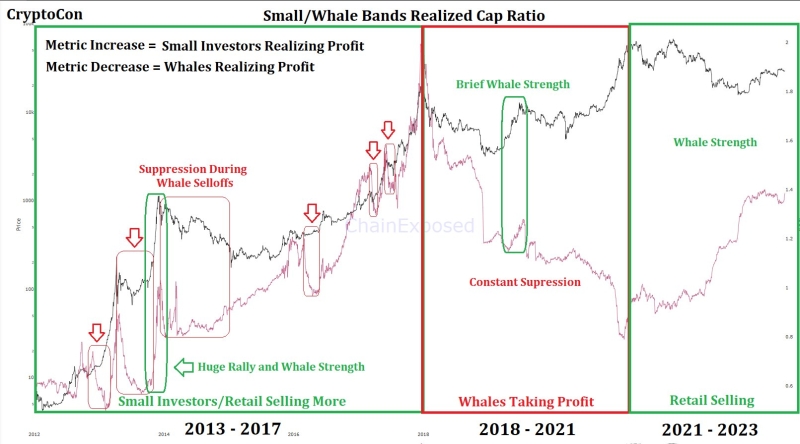

Continuing, popular technical analyst CryptoCon called whales “diamond hands” thanks to their behavior during the current cycle.

“The small investor to whale ratio is full force surging. What does this mean? The investors that have been selling this cycle (2022 – 2023) are small, whales are holding,” part of analysis from Aug. 3 read.

“This is powerful for price which can be seen in the past when the metric surges.”

CryptoCon added that Bitcoin’s last cycle was characterized by “relentless” whale selling — something notably absent today.

“Retail sold this last bear market, whales didn’t flinch,” he concluded.

“The wind is at our backs this cycle, this is big.”

All hinges on BTC price 200-week moving average

Garner meanwhile reiterated the significance of the Bitcoin-to-stablecoin ratio on major exchange Bitfinex.

As Cointelegraph reported, this is currently exhibiting behavior that has preceded every major bull run in Bitcoin’s history.

“Bitfinex Whale is important. Bitfinex is *the* smart money exchange. Bitfinex Whale drives short-to-medium term price action, more than any other entity in crypto,” he argued.

When such a bullish BTC price breakout could occur, however, remains unknown, with Garner favoring a Q3 launch.

“Bear’s other strongest counter-argument is summer seasonality. A more potent force than most realize,” he acknowledged.

“That shakeout will come. But likely not until September. Markets should still have weeks to run.”

To invalidate the bullish take, he concluded, Bitcoin would need a weekly close below its 200-week simple moving average (SMA), currently at $27,235, per data from Cointelegraph Markets Pro and TradingView.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.