As per Glassnode’s update, more than 70% BTC holders were in a profitable position as of 4 July. However, the profit-gaining attitude could see traders selling their BTC at the ongoing price leaving the king of cryptocurrencies in a vulnerable spot.

- The supply of BTC in profit surged to 72.3% as of 4 July as per data from Glassnode

- Bitcoin has been regaining its appeal and inflation might not be a major threat anymore.

Profitability is one of the biggest factors that investors consider before buying an asset. You might thus find Glassnode’s latest statistics on Bitcoin [BTC] profitability to be quite interesting. Possibly even confusing.

Is your portfolio green? Check out the Bitcoin Profit Calculator

The supply of BTC in profit recently climbed to 72.3%. But just what does this mean for traders? Less than 50% of the supply in profit at its lowest point during the lowest point in 2022.

Now that the market has been recovering, the level of BTC profitability also improved. But that’s not all.

The Adjusted #Bitcoin Percent Supply in Profit has reached a value of 72.3%, equivalent to 10.8M coins holding a profitable position.

When assessing the percentage of trading days with a greater value than 72.3%, we note 49.2% of trading days have recorded a larger value. This… pic.twitter.com/yiGX6Hm9MW

— glassnode (@glassnode) July 4, 2023

The BTC supply in profit is based on prices above $30,000. In other words, roughly 72% of the BTC acquired below the $30,000 price range is now in profit. While that number seems high, it suggested that there was quite a high level of confidence among BTC holders.

On the other hand, it also calls attention to the potentially heavy sell pressure if investors are incentivized to sell.

Will inflation finally favor BTC?

The market direction remains at the mercy of multiple market factors. Inflation has been among the major factors that have influenced BTC prices in recent months. This is because the remedy for inflation has mostly been raising interest rates.

Unfortunately, high-interest rates tend to discourage investment, hence asset prices fall. Recent data suggested that analysts anticipate lower core inflation.

Core inflation the worry, expected to also tick lower at this month's print… but not where it needs to be. pic.twitter.com/80lv0u02Hl

— tedtalksmacro (@tedtalksmacro) July 4, 2023

BTC prices were bearish during months when inflation escalated. This means higher than anticipated inflation might yield some selling pressure. However, that does not necessarily have to be the outcome since BTC was initially created as a hedge against inflation. But, heavily leveraged BTC positions played a huge role in initiating sell pressure due to liquidations.

Recent findings also revealed that BTC was now no longer correlated to the S&P 500. In other words, BTC is no longer playing by the rules of the traditional investment market. Some see this as a chance for BTC to finally function as an inflation hedge. After all, most of the overleveraged liquidity has already been weeded out.

Bitcoin's correlation to the S&P 500 has gone back to zero.

As blockchain is in no way connected to interest rates, it should have a very low correlation to the main asset classes (stocks, bonds, real estate), which are tightly driven by rates.

More: https://t.co/6xoXJhvU04 pic.twitter.com/GZNXJNzZKz

— Dan Morehead (@dan_pantera) July 3, 2023

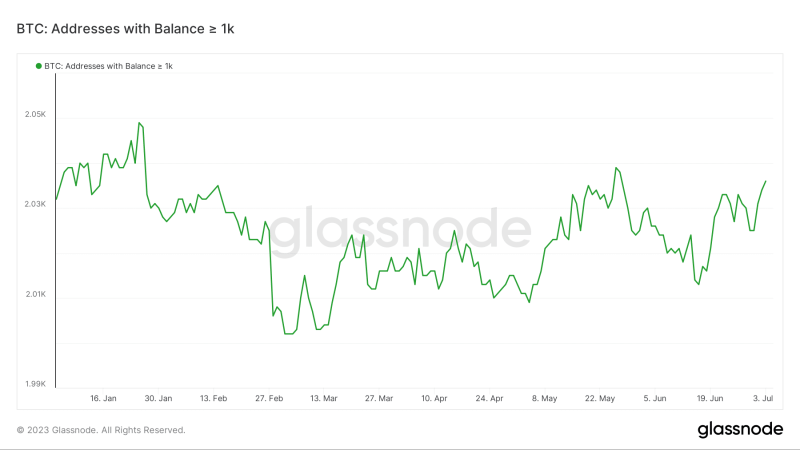

A look at address activity revealed that more whales have been finding BTC attractive in the last few months. For instance, addresses holding at least 1,000 BTC have been rising since early March.

Read about Bitcoin’s [BTC] price prediction 2023-24

In summary, BTC has been receiving a lot of attention in the last few months. Market confidence has improved significantly, especially after the events of 2022 judging by the profitability. So much that even whales have been getting in on the action.