Contents

Bitcoin Futures surge as an unconventional exchange dominates, reaching a record $4 billion on CME. Traders anticipate further gains, reflected in a positive funding rate of 0.01%.

- Bitcoin Open Interest on CME hits over $4 billion.

- The Bitcoin weighted funding rates remain positive.

The Open Interest in Bitcoin [BTC] Futures has experienced a notable rise in the past few days, rising along with the price of BTC. Surprisingly, a specific exchange, not the typical one, has garnered the highest percentage of Open Interest in Futures.

CME leads Bitcoin Futures Open Interest

As of 10th November, as reported by Glassnode, the Open Interest for Bitcoin Futures on the CME exchange achieved a record high. The exchange’s value rose to $4 billion, making up 27% of the overall Open Interest.

Analyzing the state of the Bitcoin Open Interest

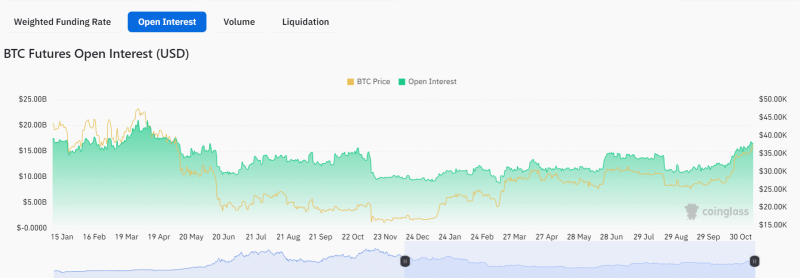

As per Coinglass data, on 10th November, the Bitcoin Futures Open Interest volume surpassed $16 billion across all exchanges.

Also, the chart showed that this volume marked the highest volume in nearly six months. As of this writing, the volume was around $16.4 billion.

Also, a look at the Futures Open Interest on CME showed that it was around $4.06 billion on the 10th og November. As of this writing, it was around $4.19 billion.

Additionally, Binance closely followed with an Open Interest of $3.84 billion on 10th November. With this volume, it secured its position as the exchange with the second-highest Open Interest.

The surge in Futures Open Interest prompts the question: what implications does this have for Bitcoin?

What does this mean for BTC?

In the context of Bitcoin futures, open interest is the total count of outstanding or unsettled contracts within the market. It signifies the cumulative number of contracts initiated but not yet countered by an opposing transaction.

An increase in open interest implies a rise in capital entering the market, accompanied by the establishment of new positions. This phenomenon often suggests a rising interest or confidence in the existing trend.

Conversely, a decrease in open interest may indicate traders liquidating their positions, hinting at a potential reversal or a weakening of the current trend.

Read Bitcoin (BTC) Price Prediction 2023-24

Funding Rate remains positive

Examining the funding rate chart for Bitcoin revealed sustained positivity. The chart peaked on 9th November, marking its highest level in months, though it has since fallen.

Currently, the funding rate is around 0.01%. This indicates that traders anticipate a continued rise in the price of BTC, leading them to assume long positions in response to this expectation.