The two largest cryptos, Bitcoin and Ethereum, have held on to their gains for more than a month since the last meaningful rise in June.

- Monthly trade volume for both assets stayed muted over much of Q2 and July thus far.

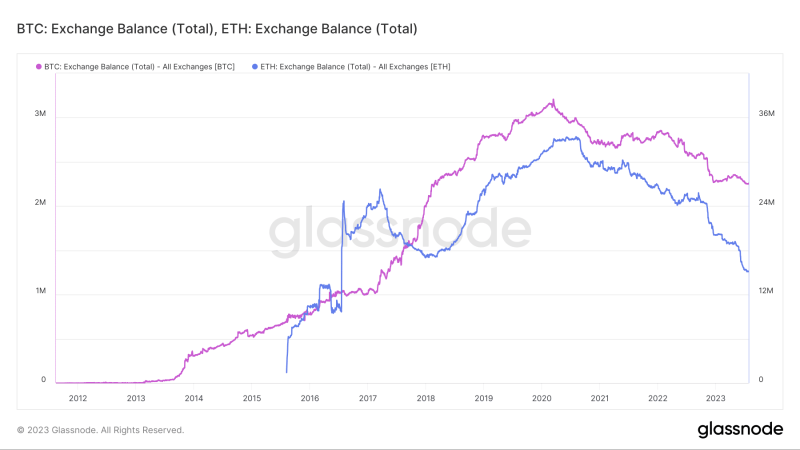

- BTC and ETH deposits to exchanges have been on a downward spiral for weeks.

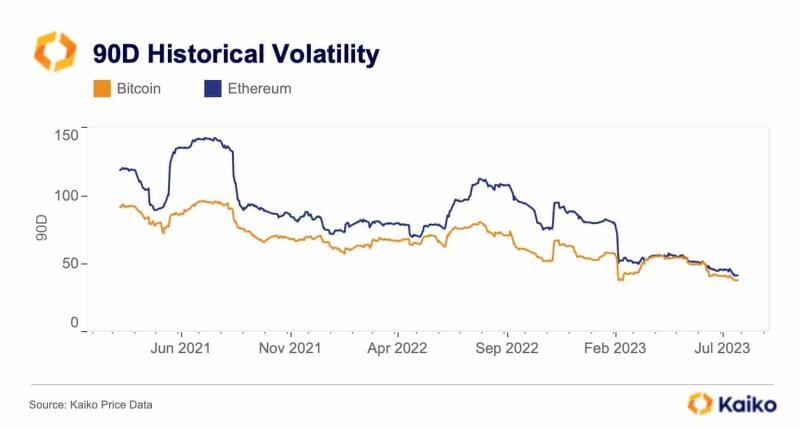

The ongoing quiet in the crypto market has put the spotlight back on one of the most-talked about topics in the sphere – volatility.

Are your BTC holdings flashing green? Check out the Bitcoin Profit Calculator

According to digital assets data provider Kaiko, the 90-day annualized volatility for Bitcoin [BTC] and Ethereum [ETH] plunged to two-year lows, giving a 360-degree flip to the historical debate over cryptos’ extreme volatility.

Inactivity engulfs crypto markets

The two largest cryptos by market cap have held on to their gains for more than a month since the last meaningful rise in June. While the king coin stagnated in the $29k-$31k range, Ethereum investors waited for a big breakout from the stubborn $1.85k-$1.95k zone, as per CoinMarketCap.

Another testament to the market’s dwindling volatility was the Bollinger Bands (BB) indicator. Since the June rally, the bands have constricted for both assets, serving as evidence that vertical movement was lacking.

Continuing drop in trade volumes

What looked like the beginning of another extended bull market in June plummeted to a damp squib for many investors. As evident from Token Terminal, BTC’s monthly trade volume stayed muted over much of Q2 and July thus far.

On similar lines, the frequency at which ETH exchanged hands went down significantly over the past few months with July showing little signs of improvement.

The dip in trading activity could be due to shrinking liquid supply i.e, the number of tokens available for buying and selling in the secondary market.

According to on-chain analytics firm Glassnode, BTC and ETH deposits to exchanges have been on a downward spiral for weeks, hitting multi-year lows at the time of writing.

Not a bad sign, is it?

Such large withdrawals can be explained by either a shift to a long-term holding strategy or a willingness to keep one’s funds in self-custody.

Is your portfolio green? Check out the Ethereum Profit Calculator

The idea of using crypto assets as a safe haven has started to gain mainstream awareness amidst a steeper decline in asset classes which are considered less risky. The recent interest shown by TradFi giants has also helped to strengthen this narrative.

In this backdrop, the declining volatility, though an irritant for active traders, had the potential to cement crypto as a legitimate asset class for investors with varying degrees of risk tolerance.