US tech stocks ‘beat’ BTC in Q2 ahead of spot ETH ETF S-1 approvals in early July.

Edited By: Ann Maria Shibu

- US tech stock, based on the Nasdaq Composite, was up 7%, while BTC was down by 7% in Q2.

- Crypto fund hedge exec projected BTC could extend the dismal performance into Q3.

Bitcoin [BTC] has underperformed US stocks in Q2, and the trend could extend into Q3.

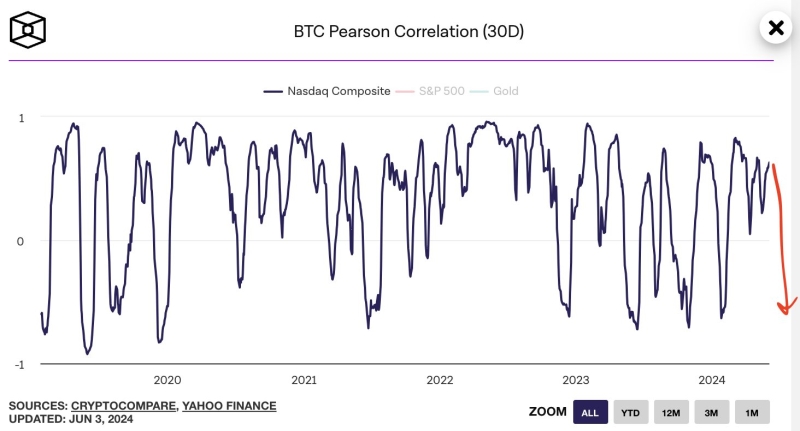

According to Quinn Thompson, founder and CIO of crypto hedge fund Lekker Capital, BTC’s negative correlation with major US tech stocks could intensify in the next few weeks.

‘I suspect over the next 4-6 weeks we get one of these’

The Nasdaq Composite tracks major US tech stocks. The correlation between the index and BTC is typically tracked by the BTC Pearson Correlation.

Interestingly, the Index has printed a new record high while BTC nosedived to $65K. Per Thompson, the correlation could retreat lower (marked by the red arrow) due to unfavourable macro conditions based on the Fed’s ‘hawkish’ stance.

Should you bet on US stocks or BTC?

Overall, BTC has been outperforming US stocks in the past seven years. The king coin maintained its win in Q1 2024, too, rising 67%.

However, in Q2 2024, gold and US bonds have ‘beaten’ the largest digital asset.

Per recent Bloomberg report, JPMorgan analysts were ‘skeptical’ about the current pace of crypto inflows extending for the rest of 2024.

As of press time, BTC was down nearly 7% in Q2. On the contrary, the Nasdaq Composite (IXIC) and S&P 500 Index (SPX) were up 7.7% and 3.4%, respectively, TradingView data revealed.

So, per Thompson’s projection, further decoupling between BTC and US tech stocks could suggest that US tech stocks might maintain their lead on the king coin in the next month or so.

However, on year-to-date (YTD) performance, BTC was up double digits compared to US indices’ single-digit gains.

Quinn Thompson had previously mentioned that the recent Fed stance could mean trouble for BTC in Q3.

However, Deribit Insight’s data suggested that the bearish sentiment post-FOMC improved following a clearer timeline for spot Ethereum ETF approval, tentatively by 2nd July.

If the improved sentiment is sustained into the new week, BTC could bounce from the press time value of $66K.

However, CrypNuevo, a BTC technical analyst, was less convinced of a short-term upside. He projected possible retesting of the range-low before BTC eyes the $73.5K level, which doubled as a major liquidity cluster.