Asset manager BlackRock’s spot Bitcoin ETF application this month has ignited derivatives traders. As a result, speculators have flocked back into Bitcoin exchange-traded products but are not too keen on Ethereum funds.

Bitcoin ETF Fever Back

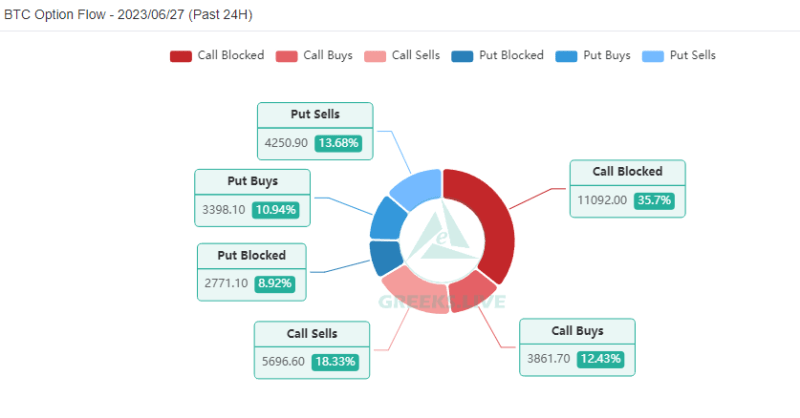

On June 27, derivatives trading analysis feed ‘Greeks.live’ reported that the latest wave of Bitcoin ETF applications by big fund managers has driven trading momentum.

“These positive developments are driving BTC, with today’s BTC block calls volume over a third of the total volume.”

Calls offer the trader the right to buy an asset at the strike price before the agreement expires. Furthermore, buyers are currently concentrating on BTC contracts as the asset remains above its max pain price.

Bitcoin Options Flow. Source: Twitter/@GreeksLive

Ethereum contracts are being sold due to the lackluster price momentum compared to Bitcoin, which has rallied over the past week.

“Due to the weakness in ETH prices, a large number of market makers have continued to sell ETH calls, while buyers have concentrated more on BTC,”

Learn more about crypto derivatives: What are Perpetual Futures Contracts in Cryptocurrency?

Derivatives analytics platform Deribit reports that BTC options calls vastly outweigh puts with a ratio of 0.33. This means that more Bitcoin ETF traders are betting BTC prices will go up rather than down (puts).

Furthermore, open interest in BTC options is currently 368,624. OI refers to the total number of contracts that remain open and have yet to expire. Around $3.3 billion worth of BTC options contracts are set to expire on June 30, which could have a much larger impact on markets.

BTC vs. ETH Price Action

The discrepancy is derived from the recent market movements of the two leading crypto assets. Over the past fortnight, Bitcoin has made an impressive 17%, mostly fueled by the string of Bitcoin ETF applications.

As a result, the king of crypto climbed to a new 2023 high of $31,185 on June 24 and remains above $30,000 at the time of writing.

Conversely, Ethereum has only managed a 7% gain over the same period. Moreover, ETH prices have failed to reach the psychological $2,000 barrier and have started to fall back.

Ethereum was trading flat on the day at $1,866 at the time of writing.