As things stand, BTC is more likely to drop in search of liquidity than to climb past $50k.

Edited By: Saman Waris

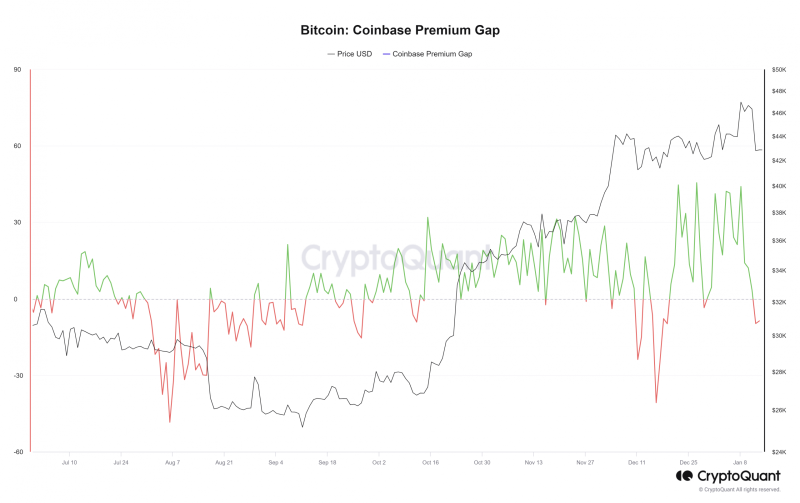

- The Bitcoin Coinbase Premium Gap went negative on the 11th of January.

- The next week may see persistent selling pressure from U.S. participants.

Bitcoin [BTC] saw eleven spot ETF applications approved on the 10th of January, and trading began the next day. Some investors expected prices to soar higher, while others argued that the event had already been priced in.

The latter proved correct, at least in the short term. BTC prices climbed to $48.9k on Binance on the 11th of January but fell to $41.5k a day later.

Ki Young Ju, the founder and CEO of CryptoQuant, posted on X (formerly Twitter) that Grayscale sent 21.4k BTC to multiple addresses in the past 30 days.

The implications were not that this outflow was the sole cause of the price drop. However, it did play a part.

Exploring the Coinbase Premium Gap

Maarten also took to X to explore the implications of this BTC outflow. He noted that after the spot ETF trading began, the Coinbase Premium Gap began to fall into negative territory.

This Premium is the difference in price between Coinbase’s BTC/USD pair and Binance’s BTC/USDT pair. Higher values mean US investors are keen on buying BTC, while negative values imply that US participants are selling their BTC.

The Premium had been positive for the majority of December and January, pointing toward strong demand. January in particular saw Bitcoin breach the range highs at $44.3k twice, but the prices fell back into the range on both occasions.

Maarten also noted that the trading volume on Coinbase was high during the American trading hours. Alongside the dropping Premium, he suggested that this could be a bad sign for Bitcoin bulls on the next trading day — the 16th of January.

Will the prices continue their slump next week?

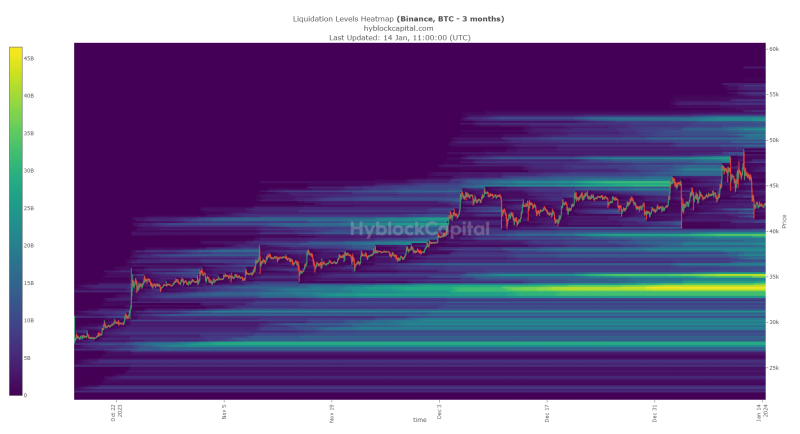

AMBCrypto analyzed the liquidation heatmap of Bitcoin to understand where prices could go next. Since liquidity is one of the primary driving forces in the market, high liquidity pockets could aid in spotting where trends could reverse.

The liquidity pool at $48k-$48.2k has been tested, and BTC faced a sharp reversal near $49k on the 11th of January. To the north, the $50.2k, $51.2k, and $52.4k levels were noteworthy areas of interest.

Lower on the chart, the $39.2k-$40k region has a much denser concentration of large liquidation levels.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Further down, the $35k and $33.8k levels were estimated to have even more liquidation levels. Therefore, in the coming weeks or months, a reversal to these levels would very likely mark a local market bottom.

As things stand, BTC is more likely to drop in search of liquidity than to climb past $50k.