After its existence on the Testnet for some time, Aave is putting measures in place to put GHO in the spotlight. Here’s how.

- Aave plans to launch its stablecoin on the Mainnet with Ethereum actively involved.

- A new infrastructure was in place to address governance and abstraction.

Aave [AAVE], the decentralized lending and borrowing protocol, has announced its plans to deploy GHO, its native stablecoin, on its Mainnet. According to the governance proposal, the launch would be accompanied by two initial facilitators. This includes Aave V3’s Ethereum [ETH] facilitator and the FlashMinter facilitator.

This move underscores Aave’s commitment to leveraging Ethereum’s robust infrastructure. It also points to the aim of achieving widespread adoption of GHO.

Two facilitators in play

The introduction of facilitators is not a new concept to GHO. In its development stage, the Aave developers mentioned that the facilitators would help in minting and burning GHO tokens.

For the Aave V3 Ethereum pool, its function is to assist with bootstrapping the GHO supply in a decentralized and permissionless. FlashMinting, on the other hand, would enable arbitrage and liquidity provision.

Introduced in February 2023, Aave implemented the Testnet for the GHO stablecoin mechanism as a cryptocurrency collateral for users who stake in the Aave protocol.

Furthermore, one of GHO’s objectives was to allow users to borrow the stablecoin while still earning the yield on their locked assets on the protocol.

Meanwhile, the proposal mentioned the use case of GHO could go beyond that. The proposal read,

Cross-chain consensus messaging means that Aave Protocol and governance infrastructure is not going to rely on single bridge but actually a consensus of multiple bridges mitigating the risks associated with cross-chain messaging and bridging. https://t.co/MI5EeDU4xX

— Stani.lens (@StaniKulechov) July 10, 2023

Developed by Bored Ghosts Developing (BGD) Labs, the new infrastructure, would ensure emergency recovery via Ethereum. Furthermore, BGD Labs mentioned that it would address consensus and generic abstraction. BGD noted that,

“As a side-effect of the other features, a.DI also becomes an abstraction layer, hiding the integration details of the underlying bridges and simplifying the DevX of people writing proposal payloads for the Aave governance.”

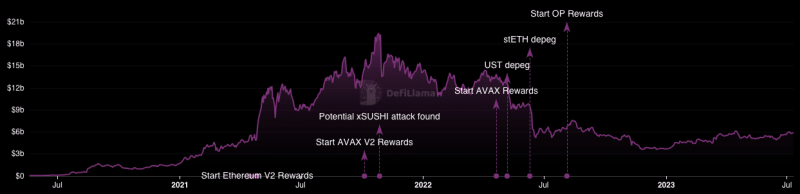

For the time being, DefiLlama showed that Aave’s Total Value Locked (TVL) increased by 12.75% in the last 30 days. The metric measures the entire value of digital assets locked or staked in a distributed application (dApp).

When the TVL decreases, it means that liquidity going into the locked smart contacts under Aave has reduced. Therefore, the high TVL means market participants’ trust in the Aave protocol has improved.