Edited By: Saman Waris

- In the last 24 hours, a whale moved 70 million XRP tokens from Binance to an unknown wallet.

- An expert suggested that XRP could experience a significant rally, similar to what happened in 2018.

After an impressive rally, the overall cryptocurrency market tumbled 2.8%, where top assets including Bitcoin [BTC], Solana [SOL], and Binance Coin [BNB] saw price drops of 4%, 5.10%, and 3.5%, respectively.

This sudden market fall has potentially created a bullish narrative for Ripple [XRP], the world’s seventh-largest cryptocurrency — here’s how.

Whales move 70 million XRP tokens

On the 30th of July, blockchain transactions tracker Whale Alert made several posts on X (formerly Twitter), noting that multiple whales moved a total of 70 million XRP tokens worth $42.48 million from the Binance exchange.

This massive token transfer occurred over the last 24 hours in three different transactions.

XRP price prediction

Per AMBCrypto’s analysis, XRP looked bullish at press time as it has formed a bullish symmetrical triangle on a daily time frame. This pattern typically appears before significant price changes.

Based on historical price momentum, if XRP’s daily candle gives a strong closing above the $0.618 level, there is a high chance it could hit $0.73 and $0.85 levels in the coming days.

At press time, XRP maintained its price above the 200 Exponential Moving Average (EMA) on a daily time frame. The price of any assets above 200 EMA on a higher time frame signals bullishness.

Other technical indicators like the Relative Strength Index (RSI) and Stochastic signaled that XRP was in a neutral zone, meaning that it was neither in the oversold nor in the overbought area.

History repeats itself?

Investor and the founder of CoinChartist Tony Severino made a post on X stating that XRP’s monthly Bollinger Bands “are the tightest ever.”

He noted that the last time this occurred — in 2018 — XRP’s price experienced a 60,000% rally.

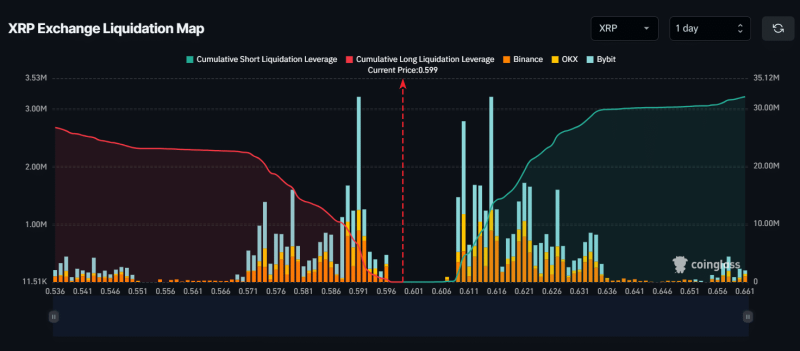

As of now, the major liquidation levels are at $0.591 and $0.615, according to an on-chain analytic firm, CoinGlass.

If market sentiment changes and the XRP price breaches the $0.615 level, nearly $12.9 million of short positions will be liquidated.

Conversely, if the price falls below the $0.591 level, $6.10 million of long positions will be liquidated.

Read Ripple’s [XRP] Price Prediction 2024-25

At press time, XRP was trading near the $0.60 level, having experienced a 1.7% downside move in the last 24 hours.

Meanwhile, trading volume was up by 9%, signaling higher participation from investors and traders during the same period.