The last three months were full of back and forth for XRP. As the quarter nears its end, here are some eye-catching events to note.

- Issued assets on the ledger improved, and XRP could be on track to beat its Q1 performance.

- Traders opened more long positions and bulls might need to counteract emerging sell orders.

After an impressive first quarter (Q1), Ripple [XRP] might be on the verge of outclassing the records of the said period. However, this would depend on the project’s ability to sustain the momentum around a number of on-chain activities.

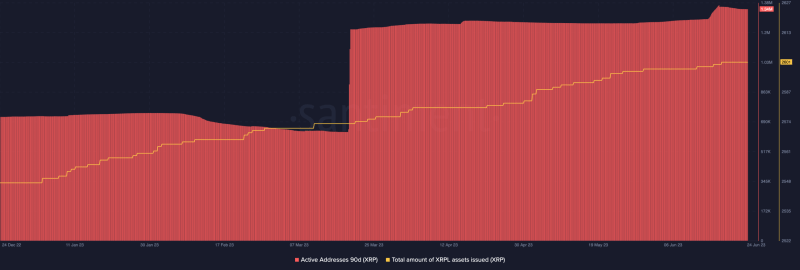

For a start, XRP’s active addresses in Q1 mostly hovered around 600,000, and 750,000 in the first quarter. However, as the last month of Q1 approached its end, there was a massive spike in the metric.

More activity on the ledger

A surge in the metric means that a tremendous number of users were actively sending and receiving tokens using the network.

So, this implied that both XRP and the Ripple blockchain became a center of attraction for many market participants. And at press time, the token maintained the hike at 1.34 million. But it would take a solid resolve to ensure that the metric trends higher for Q2 to eclipse the strides of Q1.

Like the active addresses, the total amount of assets issued on the XRP Ledger (XRPL) began rising towards the end of March and the beginning of April. At press time, the number had gone as high as 2601.

This data suggests that activity on the ledger had improved from transaction volume to wallet distribution and available liquidity.

However, XRP’s price might be a hindrance to the overall outperformance as Q2 nears its end. Recall that XRP’s price ended Q1 on a high note, with its price above $0.5.

Bulls and traders have roles to play

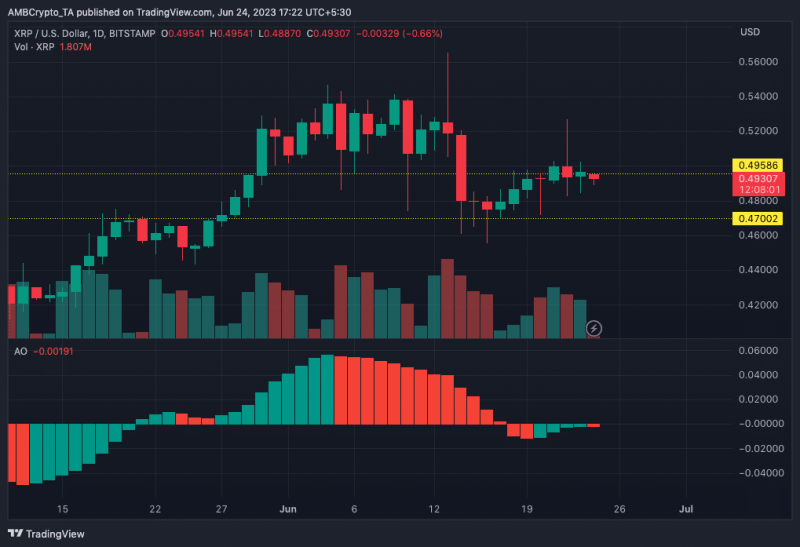

While Q2 brought glimmers of hope and several spikes, the 90-day performance remained at a 7.41% hike. But on the four-hour chart, the demand at $0.47 on 17 June has been neutralized by minute sell pressure initially created at $0.49.

This has left XRP in consolidation over the last few days. If XRP was to end June better, then bulls might need to control the price around the same sell region.

Furthermore, the token might also need to clear out the negative momentum displayed by the Awesome Oscillator (AO).

At press time, the AO was -0.0019. This negative value implies that the slow-moving average was greater than the fast-moving average. Hence, this puts bears in temporary control.

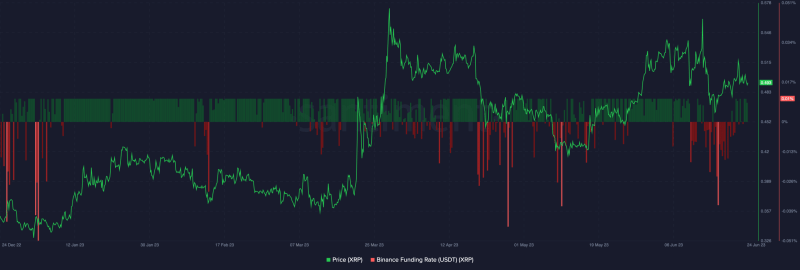

Additionally, market participants might need to sustain the funding rate state. At the time of writing, the XRP’s funding rate was 0.01%.

This suggests that long-positioned traders were dominant, and paying shorts to keep their positions. Also, continuous payment of funding fees to shorts might keep the XRP trajectory in the upward direction over time.