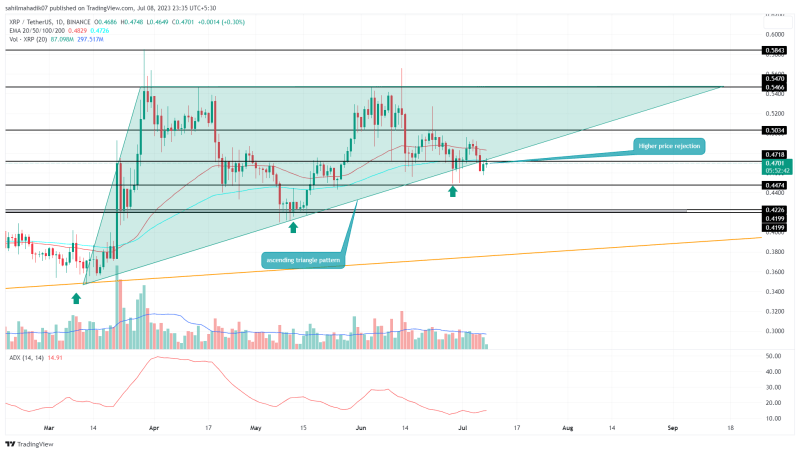

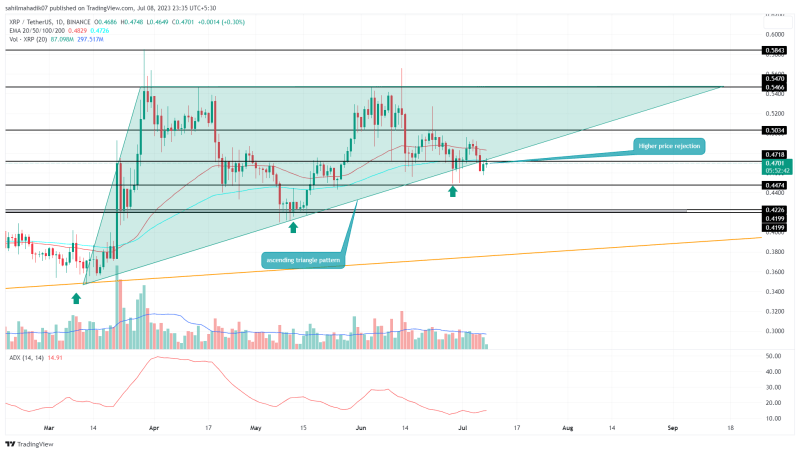

XRP Price Analysis: On June 6th, the XRP price gave a bearish breakdown from the support trendline which carried a steady recovery for nearly four months. The downfall signals a change in market sentiment and the possibility of a downtrend continuation to $0.42. Is the XRP price poised for a massive correction or there’s a hope for buyers to reclaim higher ground?

Also Read: Bank Of America Praises Ripple’s Cross-Border Payments

XRP Price Daily Chart:

- Triangle pattern breakdown intensifies the supply pressure on XRP price.

- A daily candle with higher price rejection project overhead selling pressure is active

- The intraday trading volume in the XRP is $414.5 Million, indicating a 43.3% loss.

Source- Tradingview

Failing to rise above the $0.54 multiple-month resistance, the XRP coin prices crossed below the crucial support trendline leading to a recovery trend from Mid-March. With a 14% fall in the last month, the altcoin has come closer to the crucial psychological support level of $0.45.

The crackdown of the support trendline line nullifies the formation of an ascending triangle pattern in the daily chart. Thus the bearish conclusion of a bullish pattern is rare a reflects the aggressive nature of sellers.,

Currently trading at $0.4675 ripple prices shows a short bullish relief from the 200-day EMA. This last-minute support of these EMAs could be buyers’ final push to reclaim trend control. A price jump back above the support trendline will invalidate the bullish thesis and pave the way for fresh recovery.

Will the XRP Price lose $0.45 Mark?

With an intraday gain of 0.34%, it retested the breached trendline of the triangle pattern. A long-wick rejection attached to the daily candle indicates the sellers are defending the new resistance which could lead to a continuation of the downtrend. The interested trades can take short-sell entries at this price and wait for a safer entry below the 200-day EMA. The potential downfall may plunge the prices back to $0.42.

- Exponential Moving Average: The daily EMAs(20, 50, and 100) above the coin price could exert additional selling pressure against buyers.

- Average Directional Index: An uptick in the daily ADX for falling prices indicates strength in market sellers.