Before Worldcoin officially launched, users from Kenya registered in droves. But a new government decision may affect the project.

- The Kenyan government highlighted concerns about “illegal” data collection.

- Social dominance increased, and the WLD price surged by 3.85% in the last 24 hours.

Less than two weeks since the Worldcoin [WLD] Mainnet launched, the project has not ceased experiencing scrutiny and rebuttal. Apart from the perusal in some parts of Europe, Kenya has become the latest country to have sanctioned Worldcoin.

Pushed out of the crib

But this time, it’s not just an investigation as Kenya has outrightly suspended Worldcoin activities in the country.

The Kenyan authorities, in an announcement released by the country’s Ministry of Interior and National Administration, noted that it was concerned about the project’s data collection through the eyeball or iris.

Recall that one of Worldcoin’s models of offering digital identity participation is by scanning users’ irises through the “Orb”. This did not sit well with the Kenyan government. So, it went ahead to decide that,

“Accordingly, the Government has SUSPENDED, forthwith, the activities of Worldcoin and any other entity that may be similarly engaging the people of Kenya until relevant agencies certify the absence of risks to the general public whatsoever.”

This decision could serve as a setback for Worldcoin since Kenya is one of the regions where it got the largest sign-ups. And the surge in users did not just happen when Worldcoin officially launched.

Rather, the Kenyan crypto community has had its eyes on the project since it was in the development stage. AMBCrypto previously reported that, even after the public launch, Kenya had the highest number of searches related to WLD.

Network activity improves, and WLD joins

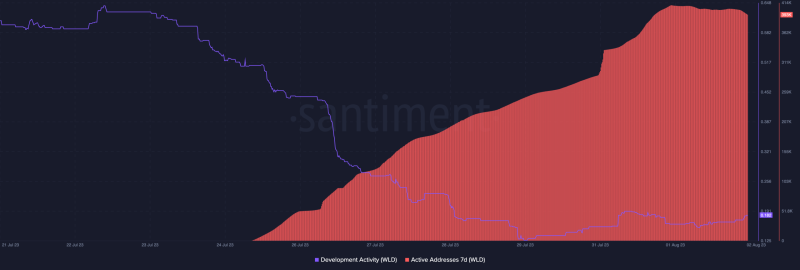

However, between 25 July and the time of writing, the number of WLD active addresses increased from less than 10,000 to 393,000. Active addresses show the number of unique addresses involved in transactions within a network.

Therefore, the spike in active addresses means that speculation around the token improved. Regarding development activity, Santiment showed that the metric had decreased.

At 0.182, the development activity showed that public GitHub repositories linked to Worldcoin has reduced.

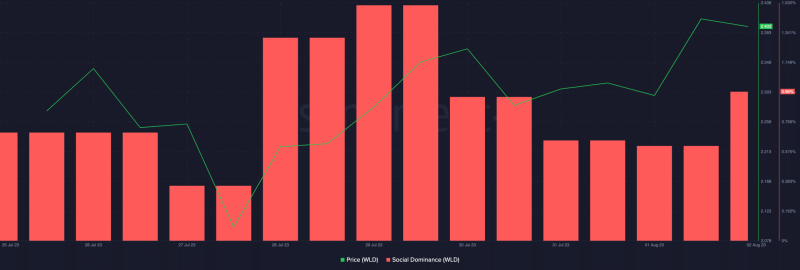

Interestingly, WLD’s social dominance increased after a long flatlined position since 30 July. Social dominance measures the share of discussion around an asset compared to the other cryptocurrencies in the market.

When social dominance increases, it means that the asset has a high percentage of hype. But when it falls, it implies that discourse around the asset is decreasing.

So, the former was the situation in Worldcoin’s case. With respect to price, WLD has increased by 3.85% in the last 24 hours.

As it stands, Worldcoin may need to be vigilant as there are chances that another entity could restrict its operation in another region.