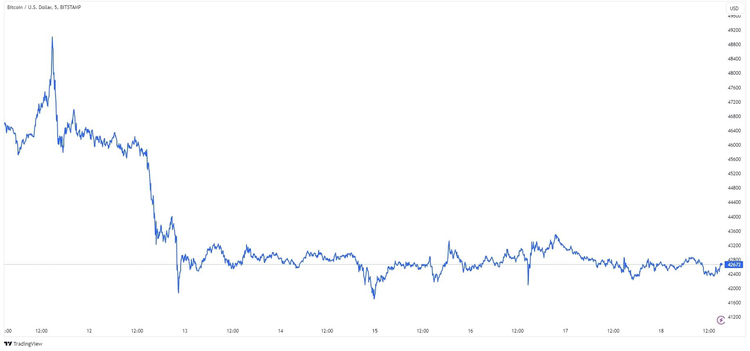

In the days following the much-anticipated launch of spot Bitcoin ETFs in the US, the price of the main cryptocurrency corrected by 14%. Bitcoin quotes at the start of the products first crossed the $48,000 mark but then fell below $42,000. However, altcoins were able to hold their positions. Unfortunately for investors, the approval of the spot product did not lead to a rapid increase in capitalization and liquidity flooding the market. Bitcoin ETF approval turned out to be overhyped news, marking the start of a corrective movement for the cryptocurrency. Analysts anticipate that the value of the leading cryptocurrency will be influenced by market players transitioning from the largest bitcoin trust, Grayscale Bitcoin Trust, to spot BTC ETFs from other issuers offering lower fees. The current market situation draws parallels with 2019, where, in the lead-up to the halving, BTC experienced a significant drop in its exchange rate. In the worst-case scenario, the value of Bitcoin could potentially roll back to $23k. BTCUSD after BTC ETFs approval. Chart by TradingView Since the ETF’s launch last week, Bitcoin’s dominance is down 6% to just under 51%. Altcoins are showing significant growth, a classic outcome of a bull rally and further correction of BTC. Ethereum and ERC20 tokens have become attractive in the eyes of investors due to speculation over the future approval of a spot Ethereum-ETF. After falling to yearly lows, the ETH/BTC ratio rose sharply. ETH is considered the clear favorite for the next ETF approval in the US. And as we know, altcoins are very likely to follow Ethereum. In addition, the low volatility of BTC is good for altcoins. Institutional involvement might help reduce the volatility of the instrument. The Altcoin Season Index has already reached the 78 out of 100 mark. This means that 78% of the top 50 altcoins have outperformed Bitcoin in terms of growth over 90 days. In the evolving crypto landscape, the spotlight on altcoins signifies a broader diversification trend among investors seeking opportunities beyond the established dominance of Bitcoin. The opinions expressed in this article are those of the authors.