With Ripple’s association with the International Swaps and Derivatives Association (ISDA), the XRP fervor has gained considerable momentum lately. But is it true, or is it just another tactic to get the so-called XRP army rattled?

Idealistic XRP Price Prediction

Digital Perspectives’ Bradley Kimes incited a flurry of discussions with his tweet. He emphasized the potential ramifications of Ripple’s partnership with ISDA on the price of XRP. Kimes suggested that mainstream adoption makes a lofty target of $1,896 possible.

“Now that Ripple has joined ISDA take a look at the possibilities for XRP Price and adoption. $1,896.23 per XRP. It’s always been about how much adoption,” said Kimes.

However, this claim, rooted in game theory, necessitates a rigorous examination.

The underpinning logic of this prediction relies on XRP capturing a staggering 10% of the derivatives market. This is a market touted to be worth around $1 quadrillion. Simple mathematics implies that XRP must process a hefty $100 trillion, requiring its market cap to burgeon by nearly 2,865 times.

This multiplication consequently lands XRP’s price at the much-contested figure of $1,896 per token.

Are you curious about the future of XRP? Our technical analysis brings you the latest XRP price prediction for 2023 and beyond.

Nonetheless, skeptics challenge the very premise of this prediction. A prominent critique centers on the assumption that derivative transactions would use XRP’s entire circulating supply simultaneously.

“This calculation is so flawed. It assumes that all the transactions would have to be done at the same time with the entire circulating XRP supply. Absolutely useless exercise,” said crypto analyst John Aldinio.

Though the calculation might seem straightforward, the real-world implementation is complex. The multitude of factors influencing cryptocurrency prices makes such astronomical targets appear idealistic.

“The purchases and sales of derivatives have no direct effect on the price of the underlying asset. What a healthy derivatives market would signify is liquidity and a healthy demand in spot XRP. That would be the driver of price, not the derivatives market itself,” added another crypto enthusiast.

SEC vs. Ripple Lawsuit

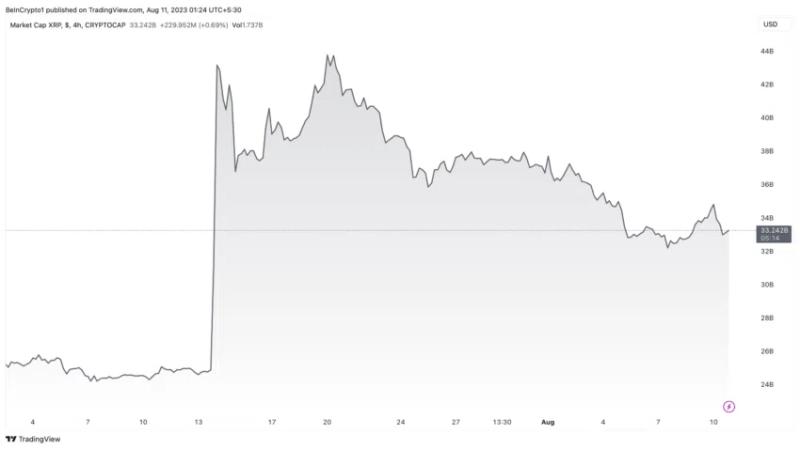

XRP has weathered a decline in its market capitalization by about $10 billion from its annual peak. This dip was primarily catalyzed by Judge Analisa Torres’ verdict that did not conclusively classify XRP as a security.

Adding another layer of intricacy is US District Judge Jed Rakoff’s critique of Judge Torres’ ruling. Rakoff’s discernment of the Howey test, pivotal in classifying assets as securities, sharply contrasts with Judge Torres’ decision.

“Howey makes no such distinction between purchasers. And it makes good sense that it did not. That a purchaser bought the coins directly from the defendants or, instead, in a secondary resale transaction has no impact on whether a reasonable individual would objectively view the defendants’ actions and statements as evincing a promise of profits based on their efforts,” said Rakoff.

XRP Market Cap. Source: TradingView

The legal turbulence has dented XRP’s valuation. It also disrupted the trajectory of renowned crypto exchange Coinbase in its litigation with the SEC.

Judge Rakoff’s dissent has even prompted exchanges like Kraken, Coinbase, and Gemini to reconsider their XRP listings, a move that once propelled its liquidity.